BIBA2022 playback

13 May 2022

BIBA was back with a smile this week after a 2 year absence.

There was an overriding vibe of goodwill and camaraderie. Far from lockdown causing introversion, the collective brought out the best in people. The willingness to talk, look forwards, and do business was palpable. It was as though 2 years had been spent in a cave and we all needed to make up for lost time with interactivity and ideas.

The Insurers

The insurers were out in force, manning sprawling stands with baristas and intimate meeting areas. There was a pleasing decline in the quantity of useless plastic tat being larded into the obligatory tote bags. The stand designs were largely elegant and pleasing on the eye, with the ends of the spectrum being bookended by the two As: Allianz’s staid but environmentally worthy cardboard setup, and Ardonagh’s chandelier, leather sofas and a general sense of the old-world.

Socks

I stayed on the Ignite stand for almost all of the conference, such was the footfall and general interest. Socks were our only give-away and it turned out (much to my relief) that 500 pairs was just about the perfect number. It certainly brought a smile to see a couple of punters flashing blue-plaid ankles at us as they passed by on day two. Nice to think of those socks winking up at people from their sock drawer for many mornings to come.

Drinks

Almost all the drinks we had labelled in our fridge for people we wanted to see were claimed. Far from just seeing familiar faces though there was a surprising number of new enquiries. I had thought this conference would be mainly about brand awareness for Ignite, but in the end we’ve got 8-10 genuinely interested parties looking for new policy admin systems. Worth saying also that there was a delightful lack of new competition in our area of expertise, and an aching void of innovation from the big legacy software houses.

I didn’t make it to a single break-out area or talk so I can’t usefully comment on those, except to say the lineup of speakers seemed excellent.

BIBA vs Expo?

Having been to Broker Expo in November I can confidently say that BIBA still has the upper hand. We’ll certainly be back next year, hopefully more closely aligned with our colleagues on the Verisk stand who were showcasing some seriously good stuff. More on that another time… for now, enjoy your socks if you got some, and thanks for the good times.

Employee Spotlight: Steven McManus

27 April 2022

STEVEN MCMANUS

Apprentice Software Engineer

Steven is an Apprentice Software Engineer here at Ignite!

Learning and working on the job as an apprentice, Steven plays a pivotal role in Ignite’s growth by bringing fresh, innovative ideas to the development of our services and software systems.

As one of our ‘newbies,’ we’ve asked Steven to answer a few questions for our latest Employee Spotlight piece…

What are you most looking forward to with regards to your new role at Ignite?

Over the next few years I’m excited to grow and develop my competency within the role.

I am thrilled to work alongside the rest of the Ignite team to innovate and improve upon the existing systems in place as well as expand our software horizons to maximize the efficiency of both our product and processes.

What drew you to Ignite?

Ignite is a frictionless collaborative customer-driven company that has welcomed me and my fellow newbie peers in a way no business has before.

The company culture was a definite draw for me and that remains unchanged to this day.

How do you define success?

As a pretty dedicated online gamer I’d personally consider success to not be winning or losing, but the enjoyment and learning process along the journey there.

Get to know more Ignite newbies in our Employee Spotlight Series:

Christian Wright, Head of Business Development

Matt Snape, Head of Sales and Marketing

Interested in an apprenticeship at Ignite? Click here to find out more.

Employee Spotlight: Matt Snape

8 April 2022

MATT SNAPE

Head of Sales & Marketing at Ignite

Matt joined Ignite this month as Head of Sales & Marketing, tasked with supercharging Ignite’s marketing strategy and sales pipeline, and spearheading commercial opportunities that leverage Ignite’s position within the Verisk group.

Matt has extensive experience (over 25 years in fact) in providing technology solutions to insurers and brokers in the general insurance and the London Market insurance marketplace. Having led teams at Charles Taylor Insurtech, SSP, and CGI, Matt brings a wealth of experience and expertise to Ignite.

Carrying on from our first Employee Spotlight on our new Head of Business Development, Christian Wright, we’ve also asked Matt a few questions so we could get to know him a little bit better…

What are you most looking forward to with regards to your new role at Ignite?

To help expand the business footprint in the market and helping Ignite become a brand leader.

What difference do you hope to make?

To help win new and larger brokers and use the Verisk brand to help achieve this.

What drew you to Ignite?

The opportunity to take an already established business and go to the next level of business growth.

3 words you would use to describe Ignite

A disrupter, agile & an opportunity.

What do you hope to achieve in the next 2-5 years at Ignite?

To realise significant revenues both top line and bottom line.

Tell us a random fact about yourself (that you’re willing to share)

I was in the army for 6 years.

If given a chance, who would you like to be for a day?

The prime minister

If you could do another job for just one day, what would it be?

Professional golfer

How do you define success?

Where everyone in the organisation benefits.

If you could only drink one beer for the rest of your life, what would it be?

Not beer – but Gin!

Three words to best describe you

Fun, driven, respectful

What are three career lessons you’ve learned thus far?

Some patience, to listen & look for the business value.

What are your hopes for our industry?

To continue to look to improve the way insurance adds value and not seen as a necessary evil.

Connect with Matt on LinkedIn!

Employee Spotlight: Christian Wright

29 March 2022

CHRISTIAN WRIGHT

Head of Business Development at Ignite

Christian joined Ignite this month as Head of Business Development, tasked with seeking new partner and client opportunities, as well creating and advocating innovative new products.

Having spent over 20 years at CDL as an insurer liaison, product manager and business development lead, Christian knows the insurance and technology business well. To help us get to know Christian a little bit better we asked him to answer a few questions…

What are you most looking forward to with regards to your new role at Ignite?

Working with a small, highly skilled & capable team with a proven track record of seamless, speedy delivery.

What difference do you hope to make?

I intend to share my experiences of dealing with large scale Brokers and Insurers, to help deliver the remarkable Ignite platform to a much broader audience.

What drew you to Ignite?

Initially, Toby [Ignite’s affable MD], right from our first conversation. After that, it was the system. On top of that, just to add icing to the cake; it was all the people I’ve met so far. Friendly, knowledgeable and dedicated.

3 words you would use to describe Ignite

Innovative. Exciting. Efficient.

What do you hope to achieve in the next 2-5 years at Ignite?

Secure platform sales to multiple new clients, extend existing industry relationships and grow the product portfolio to attract a broader range of long term partnerships.

Tell us a random fact about yourself (that you’re willing to share)

I started keeping beer bottle caps as I’d planned to build a mosaic in resin from them. Several thousand caps and a few house moves later, I’m still planning it…

If you could do another job for just one day, what would it be?

MI6 chief

Describe what you were like at age 10

Painfully shy, but very inquisitive

If given a chance, who would you like to be for a day?

Sir Alex Ferguson (in his prime!)

Do you have a favourite quote?

Nope – I prefer my own moments of random profundity!

Do you have a favourite newspaper, publication, blog?

I read a broad range of media sources, but I particularly like sites like aeon.co

How do you define success?

Tricky question! Ultimately, success to me is achieving a planned and (relatively) expected outcome, whether professionally or personally, that allows me to feel a sense of integrity and fulfilment.

If you could only drink one beer for the rest of your life, what would it be?

Another hard one to answer! But, I’ve always been a Guinness man, so let’s go with that.

People would be surprised if they knew…

Not sure there is anything else I’d like to share in the public eye.

Three words to best describe you

Loyal. Intelligent. Driven.

What are three career lessons you’ve learned thus far?

Believe in your own narrative, but not to the extent where you ignore those of others. Nothing gets built without either a little or a lot of help, and the relationships we forge are paramount.

What are your hopes for our industry?

Further modernisation and alignment of outmoded and unwieldy processes. Sensible regulatory changes to help customers make informed choices. Harmonising personal insurable risk coverages under easy-to-read and easy-to-manage platforms for the consumer, that are still easy-to-administer for Brokers and Insurers.

Connect with Christian on LinkedIn: https://www.linkedin.com/in/christian-wright-uk/

Insurtech Insights Insights

17 March 2022

I’ve just spent two days at the Insurtech insights conference in London.

First off, the conference was better than I had expected. It had maybe 50 exhibitors and four easily accessible stages with genuinely varied and well curated content. There was a fair amount of the usual corporate billy bollocks of brand ambassadors wheeled out to spout generic nonsense about the importance of ‘data’ and ‘digital’ as a thinly veiled sales pitches for their company’s services.

But a lot of the content was good. Companies such as Collective Benefits and Bought By Many gave honest and insightful war stories about the reality of building a tech enabled business in insurance. Some of the smaller companies there with less presence in the UK also made some powerful pitches in the 10-minute technology feature slots.

Here are my two main conference takeaways:

- Insurtech is starting to be something I don’t want to be associated with quite so directly

- The advantage of experience is becoming apparent – and unproven tech is easier to spot than ever before

Why don’t I like insurtech so much any more? Well lets start with the word: what is Insurtech? It could be defined as anything technological in the insurance arena. This is a pretty useless definition as almost everything done in insurance involves some degree of technology and therefore everything is insurtech. It’s easier to define things in opposition: insurtech is the opposite of legacy tech. I think that is how people think of insurtech – as the new and bleeding edge of insurance technology.

And that was what the conference was full of: companies with great ideas and great tech, almost none of which was proven at scale. All of them claiming it’s possible to launch their product in a matter of days or weeks, and that it is product (i.e. line of business) agnostic. I’m not a buyer, but if I was I could think of no bigger turn-off than those sort of promises. It just screams naivety and lack of enterprise experience. Having taken Ignite from a concept on the kitchen table to processing millions in quotes and premiums every month, I know firsthand the unexpected growing pains of scaling up an insurtech and the utter impossibility of launching a genuinely market-ready and integrated system in days.

So that is the reason I’m not sure I want to be associated quite so directly with insurtech anymore. I want to be associated with a new middle ground (let’s call it midtech for want of anything better). I’d define it like this: a core insurance system that is not AI, not no-code, not blockchain, not embedded, but which is proven at scale, with an established customer base, cloud-based, API ready, and specialist in particular product lines. Way better than legacy, able to integrate with insurtech, but not insurtech.

R&D 2022

10 February 2022

At Ignite we spend over 50% of all our time doing R&D for our clients and core system. Here is a run-down of some of the projects we’ll be working on in 2022:

Configurable alerts

It’s all very well having snazzy dashboards (as we do) so that our clients can see all their live KPIs. But you can’t be glued to that screen and still do your job.

That’s why in 2022 we are creating a series of configurable alerts based on key data metrics so our clients get notifications when numbers and ratios important to them change.

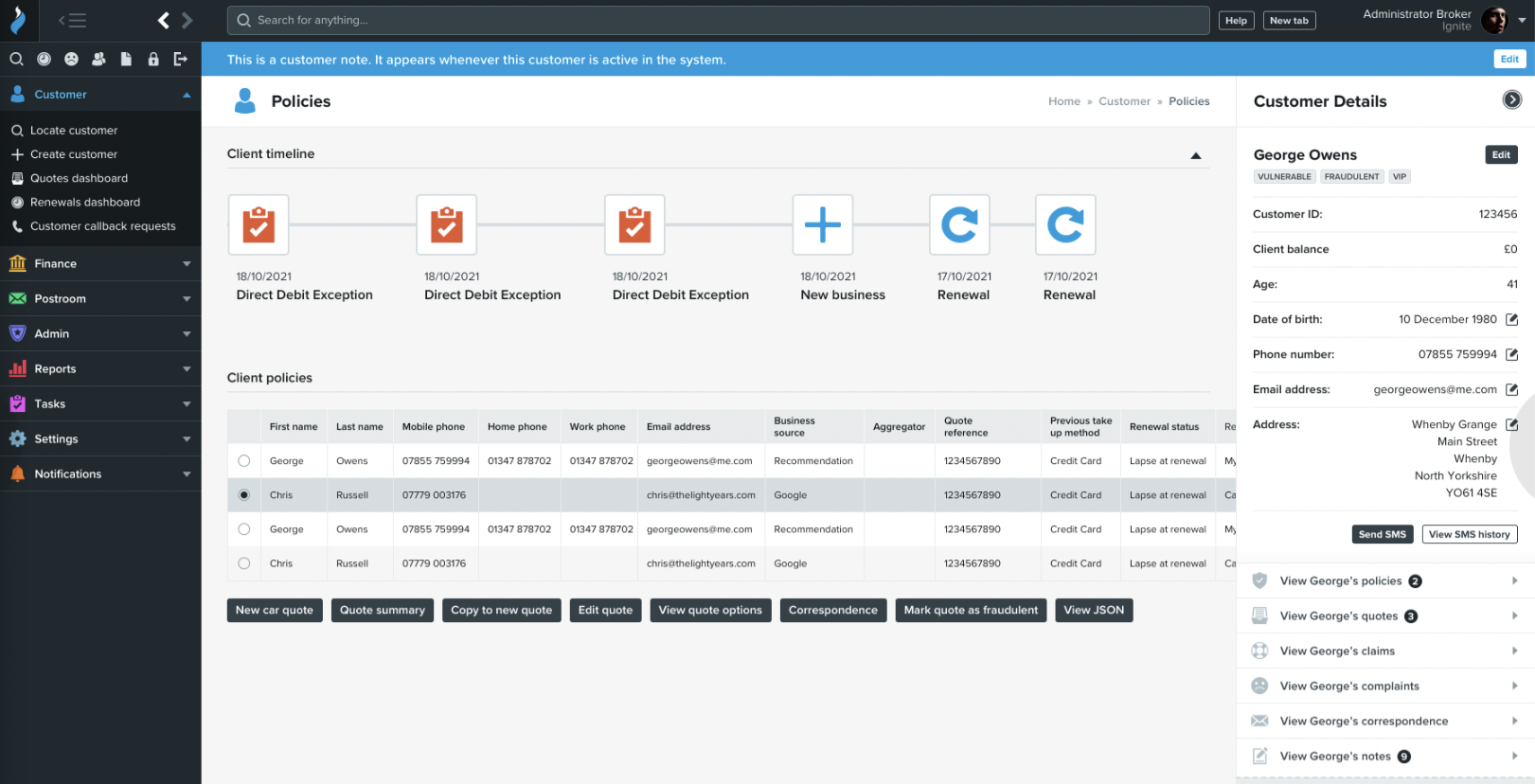

New Call Centre UI

The current Ignite back-office interface is pretty pretty but we are always looking for how to make things easier and slicker. Will be reviewing both the UI and the UX, i.e. looking at the colours, fonts and buttons, but also the accessibility of key system areas, and how to make system use as intuitive as possible. Here is a sneak peek of the early designs…

No-code question set builder

Some Ignite products (i.e. question sets) come pre-packed, like motor, home, and pet. There might be small variations which we allow but the structure is largely determined by the price comparison websites which drive the majority of traffic to these lines of business. There are of course other products which Ignite also supports. To aid the speedy development and control of these non-standard products (e.g. gadgets, cycle, gap, SME, et cetera) ignite will be expanding on our existing question set builder.

At present brokers can self configure their own products including all questions and document templates. The 2022 iteration of the question set builder will auto generate API endpoints for easy integration to third-party rating or distribution services, allow for more complex questions that design, and feature a more curated database structure.

Analytics Team & Dashboards

In 2022 Ignite will be forming a dedicated analytics team to proactively bring data insights to our broker and insurer partners.

We will build upon our existing PowerBI and Grafana dashboard tools, and leverage access to Microsoft Machine Learning tools as part of our Microsoft Partner Company status.

We anticipate that this team will help our clients optimise workflows, increase new business and renewal take-up rates, and identify new product opportunities.

Other things

As usual, we’ll be running our monthly innovation days from which many great new roadmap ideas pop up. We’ll also be putting live 6-8 major brokers, and integrating the products of 6-8 major insurers. Big year? Sure.

Data migration is fun!

1 February 2022

Data Migration

Data migration is not the fun bit. When you’re upgrading your business’ technology stack with a new system the new app is the fun bit, the automation, the chatbot… that stuff. But not the data migration.

Why isn’t it fun?

There’s a few awkward bits: firstly, before you can kick off data migration you need to get hold of all your data. As a first step this involves letting your old girlfriend (software house) know you’ve got a new one. Then, as they’re processing that little bombshell, they’re asked for a machine-readable data dump for a transfer. Like asking a newly ex-ified girlfriend if she wouldn’t mind just transcribing all your years of conversations and providing them in a4 notebooks with equally spaced columns, grouped by date. This has to be tactfully managed to avoid being a real dump of a data dump.

How it gets into the new system

There are a number of ways to get data into a new system. Not all of them are horrible, and there are often lots of benefits to the process. The basic options (all of which Ignite has done as some point) are: feeding the data through a validated API configured to requirements; using the automation framework to input risk details through the UI’s validation; rekey. Horses for courses, and none are options to be ruled out.

Benefits of data migration

Lots of companies have pre-GDPR data that they haven’t dealt with appropriately. Data transfer is an excellent way of correcting this issue. Data can also get a bit mangled over time with inconsistent inputs or database types. Data transfer, especially through a validated API or automation framework offers the opportunity to cleanse data into formats that can better reported on and understood.

Business risk

Data transfer is perceived as a business risk. It is true to an extent, but these days it is increasingly seamless: test runs can be done in minutes, and mapping is increasingly easy. Part of the skill comes in designing the new system. If, in migrating, the existing product structure is largely retained, with upgrades to the functionality around it rather than the data capture itself, then migration can be easier. Also consider how much data really needs to be transferred, and what can simply sit in an external data repository to be used for uncommon events like an investigation.

Cost

Data transfer no longer needs to be expensive. As long as there is decent access to historic data in some sort of machine readable format (e.g. historic EDI or Bordereaux) then it is something that, with proper management, can be done without headache or heartache.

The Impact of Price Walking

20 January 2022

I wrote a blog in December 2020 about the potential impacts of price walking regulation that came into effect at the start of last month. I predicted a stalemate where customers would shop around less, renewal prices would be more competitive, and new business prices would be more expensive. This has not come to pass… yet.

What we have seen so far across our broker base is a great deal of change and churn. Those brokers and insurers that practiced price walking are being hit the hardest, and those which didn’t are making hay. There is a rebalancing process underway – the aggregate market prior to the new regulation being announced was relatively stable in comparison to this month. That is all changed as companies grapple with questions such as whether to prioritise renewals or new business, and how much of a fee they can reasonably charge.

To give an idea of the scale of the flux: two brokers using the Ignite policy admin platform that didn’t historically price walk have seen new business grow 135% and 181% beyond last month, and this was only by the 20th January…. Meanwhile, another broker budgeted to write 1,100 new business and had only managed 200.

It is worth mentioning that the new legislation also heavily favours newer high-growth businesses that can afford to prioritise new business over the more lucrative renewals and build market share. Ignite powers a number of these so our stats may be skewed.

One thing has changed already: the ‘crazy’ pricing (as one top-50 broker put it to me) that plagued the market in the second half of last year (in reference to heavy negative commissions and a land grab before the regulations hit) has at least calmed down.

So, a new prediction for the future: there will be churn for the next 3-4 months, then it will calm again, but watch out for more action in Jan-23 as all these new business cases come up for renewal! Opportunities abound…

100 days of Ignite as part of Verisk

13 December 2021

Dear Diary,

It’s been 100 days since Verisk’s Sequel acquired Ignite. There is a whole backstory to that which has already been written about here. But what has actually happened in our first hundred days?

Whilst it might be my first time, our acquirer is an old hand at such things. Verisk acquire approximately 1 billion companies per year and therefore have an entire team dedicated to integrating those companies into the Verisk “family”. There are work streams for HR, finance, accounting, security, data, infrastructure, networks, training… About 12 in total.

Naturally, I have delegated furiously and my excellent team has taken the majority of the flak. That said, there has undeniably been a lot to do for everyone.

Whilst that might be a negative, there have been plenty of positives. The collective benefits to all Ignite staff of being part of Verisk are substantial. Things we couldn’t countenance/afford as a small company are now the normal: Health care, big pension, gift matching, dental… the list goes on. The call to discuss the benefits with staff took 90 minutes. There have also been substantial upgrades to our hardware, infrastructure, data security, and networks.

One of the things Verisk is very good at is not interrupting the flow of business as usual work. If ever the integration is becoming too onerous, it is put off for a few weeks so as not to be a disruption.

Getting to know a company of nearly 10,000 staff and tens, maybe even hundreds, of business units, has been quite a task. There are immeasurable benefits to being part of such an organisation – learning which are the relevant ones and which order to attack things in is the real challenge. After 100 days I feel I am now getting a sense of the whole. Everyone has been incredibly welcoming and generally disabused me of the misapprehension that large companies move slowly and attract people who do likewise. There’s lots going on and many opportunities.

I feel like I’m only just scratching the surface so far… let’s see how things have got on by day 200…

Innovation vs Stability

23 November 2021

The paradox

When you’re a young company, one of the best bits of the job is the pace of change, innovation, disruption, and new ideas. As the company grows you take on new concerns, pesky things like revenue, clients, more staff, live systems… Essentially, you become more responsible.

As a company, everyone knows you have to innovate in order to succeed. However, clients also demand stability, reliability, and predictability.

So what is the solution to this paradox?

In doing one you sacrifice the other. It is possible to achieve perfect stability if one never changes or innovates. And with a total focus on innovation, there would be little or no stability.

The answer lies in finding the right balance for both business and clients. To ensure you continue to be at the cutting edge, even as a company grows, it is vital to continually test the boundary of innovation. And that does mean occasionally putting a foot over the boundary and, to mixed metaphor, rocking the boat a bit.

In Ignite terms, this means trying new things as often as we can, and accepting that sometimes we might get it wrong and that it might have consequences (e.g. breaking some functionality or even some system downtime)

To avoid being sucked into a “stable” bureaucratic company system we must be sure to continually demystify the system itself, challenge assumptions, iterate and reflect. I usually hate buzzwords like these so I’ll break them down individually…

Demystify the system – make sure everyone knows what everyone else is doing. There should be no black boxes, closed loops, or sub-groups with mysterious priorities.

Challenge assumptions – accept that there is no one right way of doing things, and make the time to try new things and fail in the process.

Iterate – make regular changes, and make each change as small as possible. This speeds up the velocity of change and makes the effects of changes more apparent.

Reflect – always look for feedback on what could be done better, and use this to further iterate and challenge assumptions.

Ignite is growing rapidly, and even as we do so we’ll try to live by these ideas to keep us right in the middle of the fine balance of innovation and stability.