What is *real* self-service in insurance?

If you dabble in the world of insurance software (and who doesn’t) then you’ll have come across the concept – and the promise – of “self-service.”

Self-service means that customers can do things for themselves online rather than calling a call centre. This is useful for everyone: customers don’t like talking to people (who does?) and they can manage their policy out of office hours; brokers don’t want to spend money needlessly on manning a call centre (at an approximate cost of £25-£30/call).

A few of Ignite’s competitors claim to offer ‘self-service’ portals, but in reality, few actually do. If they did, why wouldn’t everyone be using them?

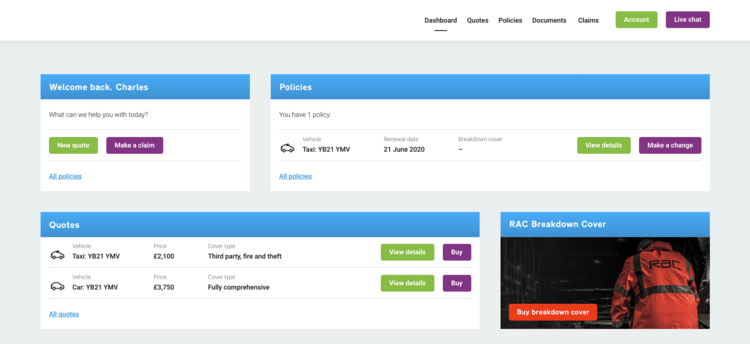

Here are a few features of the Ignite self-service portal. The ability to:

- Make changes (i.e. MTAs) of any sort

- Cancel a policy

- Renew a policy or manage the renewal by adding other details

- Purchase additional add-on products

- See claims

- View & download documents

This is an example of what it looks like:

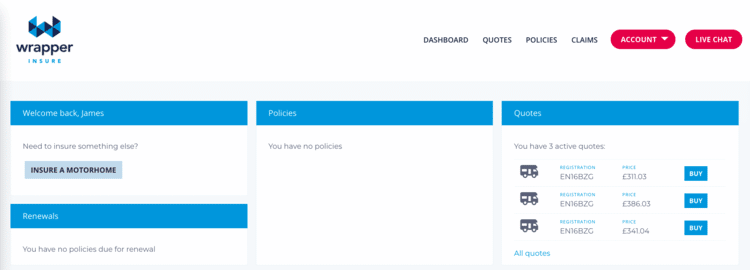

Customers who don’t have a policy can go there to retrieve a quote (this example from the recently launched wrapperinsure.co.uk)

It is important with self-service that it is both easy to use and offers a full range of functionality.

For example, my personal home insurance with Home Protect has a portal, but it is not pretty (see screenshot below), misleading (my policy looks as though it has been renewed twice) and only allows me to download my documents. This puts me off both the brand and the product.

A good self-service portal dramatically increases the number of clients a single broker operative can administer: from ~1,000 to over 10,000.

Customers expect self-service these days, so it’s now standard across all Ignite implementations.

To get ideas direct to your mailbox, please enter your details below: