The death of innovation

30 September 2021

What’s the problem?

Innovation is a good thing, right?

Usually true, but in insurance there’s a large cadre of people who take pride in their inertia. For this reason, in the past decade, there was not much real innovation in insurance. Whilst there has been more in recent years, very few of the big insurers are coming to the party. The UK is one of the more advanced marketplaces in the world, and it’s still pretty backwards by the standards of other industries (e.g. marketing, fashion, even banking is ahead of us). Why is that?

Lack of investment? No – there are billions being pumped into Insurtechs around the world.

Lack of ideas? No – there are huge communities of tech entrepreneurs like the InsurtechUK which foster innovation with great people and great ideas.

The real problem

If you ask anyone involved with insurance which are the slowest dinosaurs in the jungle the answer is: insurers. Even getting an agency (a standard contract to distribute an insurer’s products) takes months. Try to ask them to work with new technology as you’d better be prepared for a long old slog.

So there are lots of insurtech innovators out there, with great tech, great ideas, loads of funding… but nothing to sell!

The big insurers have a monopoly that is perpetuated by the big software houses. Try to set up a new insurer? That takes even longer than it does to set up a new brokerage – you’re talking about years to get approved by the FSA. What tech startup wants to spend years just getting regulated to get going?

What’s the result?

There are a small handful of large insurers, and they only work with a small handful of large software companies. Both have dated technology that prohibits innovation either from the inside or from the outside.

I spoke with one top-10 insurer last month who admitted they wouldn’t know how to integrate a new software house because they hadn’t done it for over 15 years and there was no one left who remembered! It’s not an isolated example.

What about IHP?

IHP (Insurer Hosted Pricing) was supposed to offer the insurers products to the wider market with nice interfaces that didn’t require an enormous amount of technical support or oversight from the insurer. Well, that didn’t work (see also my other blog on why).

What is the solution?

There are two ways this could go:

- Insurers could rebuild the APIs (interfaces) of their IHP solutions to make them easily accessible to all insurtechs. This would create amazing distribution possibilities for their products and foster collaboration and innovation and competition.

- A new (much bigger and scarier) breed of insurers could emerge from the likes of Amazon, Google, or large VCs. They will have distribution, technological superiority, and won’t have read the rulebook of ‘we don’t work with new companies’.

There are high barriers to entry in insurance but our current stock of insurers cannot continue to stifle innovation and hope the world doesn’t notice. Time is running out.

Personal vs Commercial Lines

20 September 2021

I’m often asked if the Ignite Broker policy admin system “does” personal lines or commercial lines. Answer: it’s the wrong question. Let me break it down for you

P vs C: is there a difference?

Simply put – personal lines products are sold to individuals and commercial lines products to companies. To that extent they’re different. And commercial products are sometimes perceived as more ‘complex’ but is that true? In fact, to my mind, personal and commercial products are very similar, and there is a better question to ask when it comes to compartmentalising lines of insurance.

What are the key differences?

Commercial products tend to be more ‘complex’ in question set and placement because there is more variety to companies than there is to pets and their owners. Commercial products can also involve multiple insurers, payments direct to the insurer, and referrals. Personal lines products tend to be more price-sensitive and therefore have more point-of-quote enrichment, complex rating tables, and e-enablement.

Having said all that, there are also price-sensitive commercial products and complex personal products with bespoke underwriting.

Open market rates

There is one key area in which some systems can be said to be either commercial or personal lines-based. That is when it comes to Open Market Rates (OMR). A small number of large (and old/established delete as preferred) software houses have built up a large panel of OMR in their particular area of expertise (i.e. commercial or personal lines). For OMR commercial lines go to Acturis (https://www.acturis.com) and for OMR personal lines SSP (https://www.ssp-worldwide.com) or OpenGI (https://opengi.co.uk). These companies do this stuff well.

I am of the opinion that OMR are increasingly insignificant but that’s a blog for another day…

So is Ignite personal or commercial?

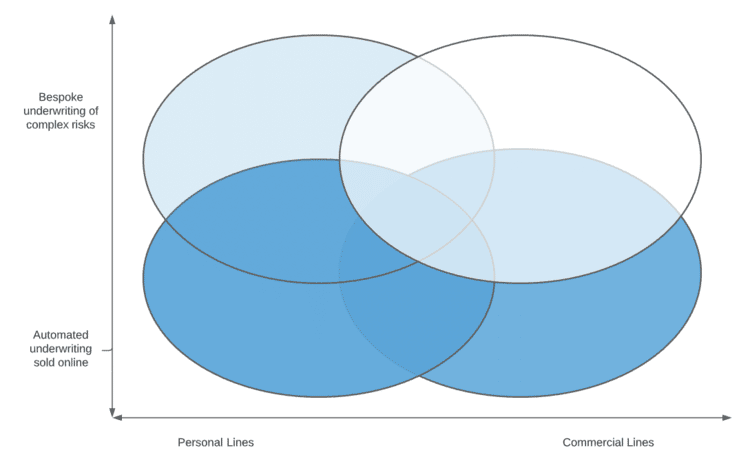

Coming back round to the question, Ignite does both personal and commercial lines, but only of certain types. Here is a sort of graph + Venn diagram to illustrate the point:

Ignite’s true sweet spot is in automated underwriting sold online (low on the y-axis). We predominantly do personal lines, because more of those products are e-enabled and traditionally fit a larger market. Having said that, Ignite is increasingly involved with SME, Cyber, and other less bespoke-underwritten commercial risks.

So can there be a cross over from personal lines into commercial lines? Absolutely! And there is great benefit to doing so: all of the learnings from complex online personal lines risks (e.g. streamlined customer journey, enrichment, automation, etc) apply to commercial too.

I suppose the conclusion is that, if you’re looking for a system for commercial products, see if you can’t find yourself a personal lines one!