Prepping for BIBA2022

31 March 2022

Ignite will be exhibiting at BIBA this year alongside 100+ other companies. One of the main benefits of BIBA is speaking to many familiar faces, but we have a stand too and we want unfamiliar faces to get to know about Ignite and our team.

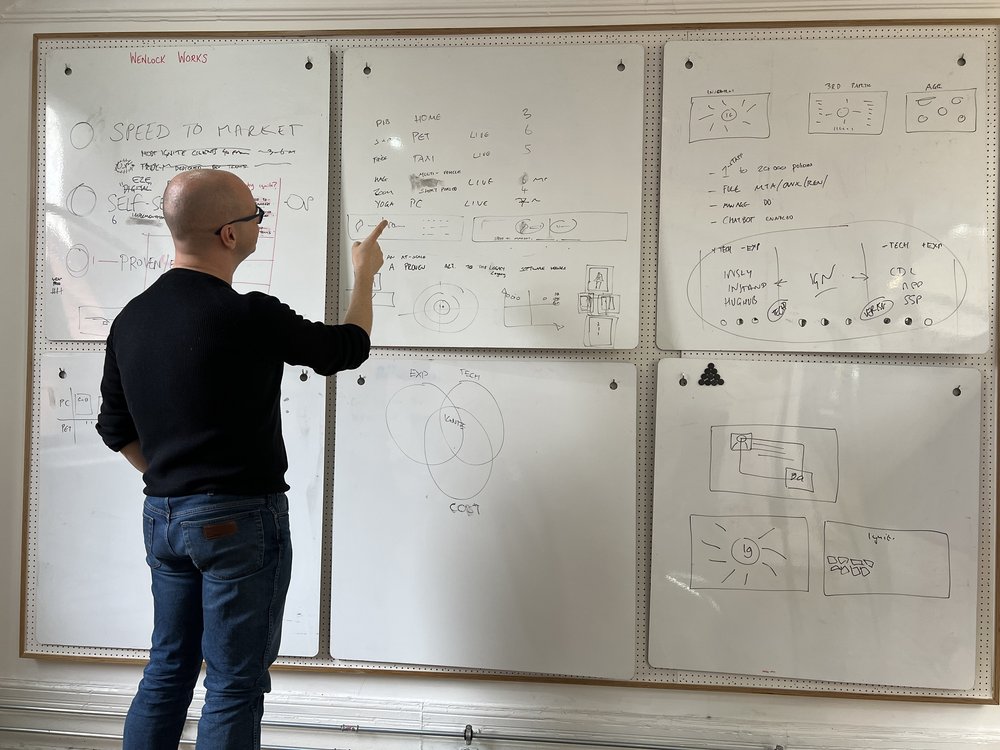

To that end I’ve just spent the day with various people in my team trying to distil the essence of Ignite’s company and product suite into a few eye-catching strap-lines and graphics.

This blog is a bit of an insight into the (slightly mad) process of putting together ideas for a stand at BIBA.

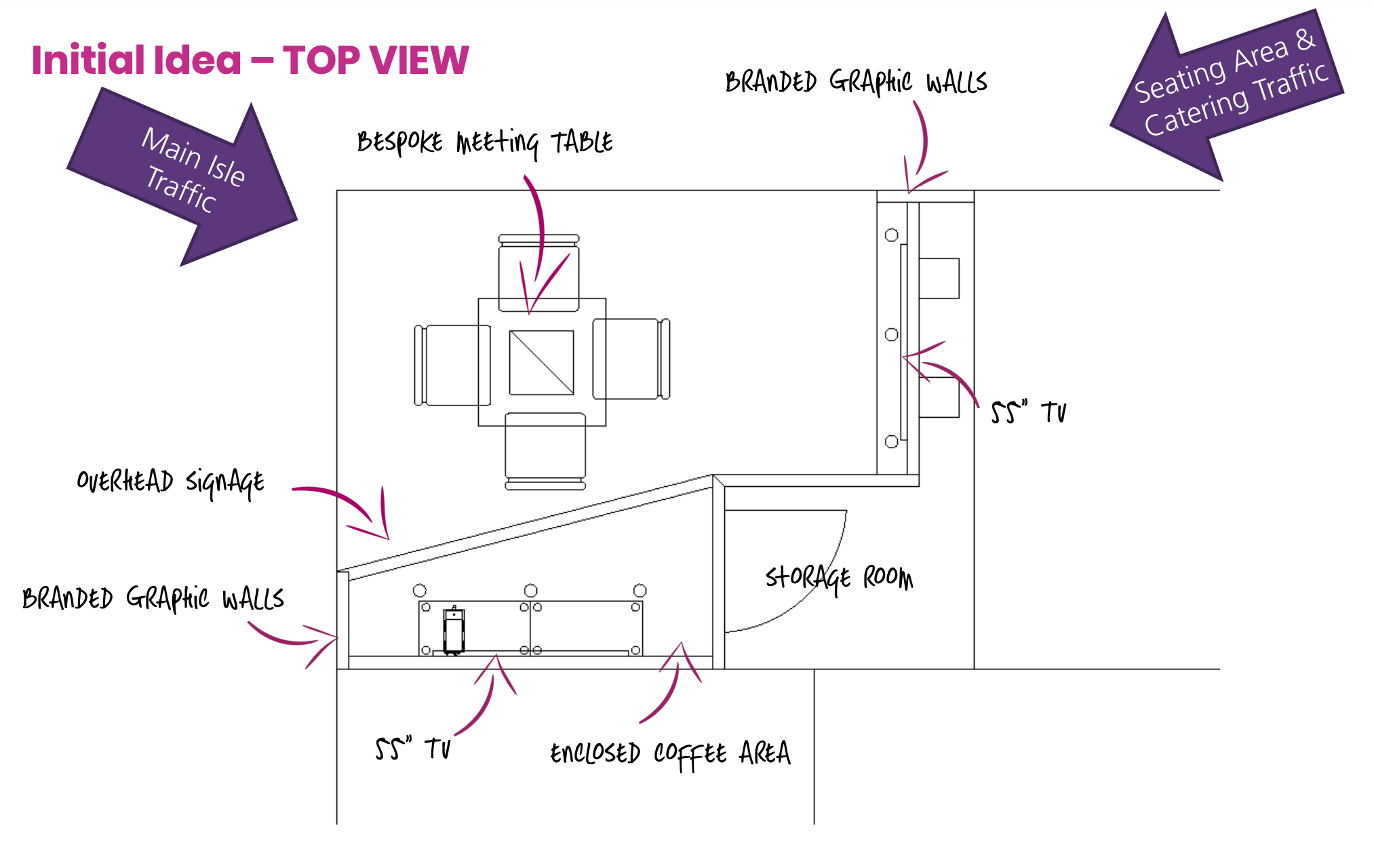

We already a stand layout design done, so this session was all about the content.

Here’s how it went down:

Questions

Broadly we considered these questions that people passing the Ignite stand might have:

- Who on earth are these Ignite people?

- What are they trying to sell me?

- Why would I ever want to buy it?

- What are they like as a company?

Themes

Addressing these questions in order we therefore thought we ought to make the themes of our messaging:

- What is Ignite? At a very high level: a fast-growing software house with increasing pedigree, disrupting legacy platforms and backed by the (enormous) Verisk group (that no-one has heard of)

- What does Ignite sell: we licence a policy management system, but that makes it sound so bland and average. Ignite’s uniqueness is that is it has good reliable tech (not the very latest but certainly not legacy) along with experience in delivering systems to personal lines brokers (which means lots of wrinkles ironed out and lots of critical integrations done). We’re both youthfully agile (8 years old) and old enough (8 years old) to have cut our teeth on some large projects and know our business. Someone mentioned the tagline: “big enough to deliver, small enough to care” – trite but we’re current that sort of size.

- Why choose Ignite: sure, we’re quick to market, end-to-end, low-code, reasonably priced, and agile – but so are all the other insurtechs out there. We’re also experienced (used by dozens of personal lines brokers) and process millions of quotes and millions in premium each month – but so do the legacy software houses. So we need a way of illustrating that we’re both innovative and experienced, because both are critical.

- What are we like as a company: agile but not naive; knowledgeable but not boring/corporate. This needs to come across in our language, the boldness of our statements, the openness of our demos, the honesty of what is achievable and what is not. And a bit of irreverence because life’s not fun if you take yourself too seriously.

Don’t mention the themes!

So these were our themes but, counterintuitively, we didn’t want to mention any of them. We wanted the reality – our systems, people, clients – to act as evidence of these things. We wanted people to infer these themes and ideas from what we were showing them. The content could not just say we are quick-to-market, experienced, or innovative. The content has to showcase speed, experience and innovation. It has to provide real-life implementation timescales, live integrations with enrichment and aggregators and AI, and visuals of the innovative chatbots, pricing tools, and customer journeys. If we have to tell people we’re innovative, that suggests we can’t show them we are.

Output

With this in mind we decided to fill the three key stand areas we have – top banner / side board / screens – with three key themes:

- What is Ignite: the UK’s fastest growing software house. This felt bold but has the advantages of being to the point, and true (by most metrics we could think of).

- What makes Ignite different: the combination of tech + experience – on top of all the tech you’d expect, we bring speed to market and enterprise experience

- Why buy it: visuals – the system should speak for itself. Put up on the screens the beautiful customer digital journeys, the chatbots, the self-service portal, and also the back office, the MI suite, etc. Put up case studies with video content and actual metrics of success. This feels open, exciting, refreshing, proud, and different.

This might seem self-evident, but it took us a good 6 hours (including burrito break) to mastermind.

Visuals

Here are some early visuals that we were working with:

Employee Spotlight: Christian Wright

29 March 2022

CHRISTIAN WRIGHT

Head of Business Development at Ignite

Christian joined Ignite this month as Head of Business Development, tasked with seeking new partner and client opportunities, as well creating and advocating innovative new products.

Having spent over 20 years at CDL as an insurer liaison, product manager and business development lead, Christian knows the insurance and technology business well. To help us get to know Christian a little bit better we asked him to answer a few questions…

What are you most looking forward to with regards to your new role at Ignite?

Working with a small, highly skilled & capable team with a proven track record of seamless, speedy delivery.

What difference do you hope to make?

I intend to share my experiences of dealing with large scale Brokers and Insurers, to help deliver the remarkable Ignite platform to a much broader audience.

What drew you to Ignite?

Initially, Toby [Ignite’s affable MD], right from our first conversation. After that, it was the system. On top of that, just to add icing to the cake; it was all the people I’ve met so far. Friendly, knowledgeable and dedicated.

3 words you would use to describe Ignite

Innovative. Exciting. Efficient.

What do you hope to achieve in the next 2-5 years at Ignite?

Secure platform sales to multiple new clients, extend existing industry relationships and grow the product portfolio to attract a broader range of long term partnerships.

Tell us a random fact about yourself (that you’re willing to share)

I started keeping beer bottle caps as I’d planned to build a mosaic in resin from them. Several thousand caps and a few house moves later, I’m still planning it…

If you could do another job for just one day, what would it be?

MI6 chief

Describe what you were like at age 10

Painfully shy, but very inquisitive

If given a chance, who would you like to be for a day?

Sir Alex Ferguson (in his prime!)

Do you have a favourite quote?

Nope – I prefer my own moments of random profundity!

Do you have a favourite newspaper, publication, blog?

I read a broad range of media sources, but I particularly like sites like aeon.co

How do you define success?

Tricky question! Ultimately, success to me is achieving a planned and (relatively) expected outcome, whether professionally or personally, that allows me to feel a sense of integrity and fulfilment.

If you could only drink one beer for the rest of your life, what would it be?

Another hard one to answer! But, I’ve always been a Guinness man, so let’s go with that.

People would be surprised if they knew…

Not sure there is anything else I’d like to share in the public eye.

Three words to best describe you

Loyal. Intelligent. Driven.

What are three career lessons you’ve learned thus far?

Believe in your own narrative, but not to the extent where you ignore those of others. Nothing gets built without either a little or a lot of help, and the relationships we forge are paramount.

What are your hopes for our industry?

Further modernisation and alignment of outmoded and unwieldy processes. Sensible regulatory changes to help customers make informed choices. Harmonising personal insurable risk coverages under easy-to-read and easy-to-manage platforms for the consumer, that are still easy-to-administer for Brokers and Insurers.

Connect with Christian on LinkedIn: https://www.linkedin.com/in/christian-wright-uk/

Insurtech Insights Insights

17 March 2022

I’ve just spent two days at the Insurtech insights conference in London.

First off, the conference was better than I had expected. It had maybe 50 exhibitors and four easily accessible stages with genuinely varied and well curated content. There was a fair amount of the usual corporate billy bollocks of brand ambassadors wheeled out to spout generic nonsense about the importance of ‘data’ and ‘digital’ as a thinly veiled sales pitches for their company’s services.

But a lot of the content was good. Companies such as Collective Benefits and Bought By Many gave honest and insightful war stories about the reality of building a tech enabled business in insurance. Some of the smaller companies there with less presence in the UK also made some powerful pitches in the 10-minute technology feature slots.

Here are my two main conference takeaways:

- Insurtech is starting to be something I don’t want to be associated with quite so directly

- The advantage of experience is becoming apparent – and unproven tech is easier to spot than ever before

Why don’t I like insurtech so much any more? Well lets start with the word: what is Insurtech? It could be defined as anything technological in the insurance arena. This is a pretty useless definition as almost everything done in insurance involves some degree of technology and therefore everything is insurtech. It’s easier to define things in opposition: insurtech is the opposite of legacy tech. I think that is how people think of insurtech – as the new and bleeding edge of insurance technology.

And that was what the conference was full of: companies with great ideas and great tech, almost none of which was proven at scale. All of them claiming it’s possible to launch their product in a matter of days or weeks, and that it is product (i.e. line of business) agnostic. I’m not a buyer, but if I was I could think of no bigger turn-off than those sort of promises. It just screams naivety and lack of enterprise experience. Having taken Ignite from a concept on the kitchen table to processing millions in quotes and premiums every month, I know firsthand the unexpected growing pains of scaling up an insurtech and the utter impossibility of launching a genuinely market-ready and integrated system in days.

So that is the reason I’m not sure I want to be associated quite so directly with insurtech anymore. I want to be associated with a new middle ground (let’s call it midtech for want of anything better). I’d define it like this: a core insurance system that is not AI, not no-code, not blockchain, not embedded, but which is proven at scale, with an established customer base, cloud-based, API ready, and specialist in particular product lines. Way better than legacy, able to integrate with insurtech, but not insurtech.