Blog

Scoping your Requirements

13 July 2021

So you’ve made the decision to buy a new Policy Administration System. Your existing system is too slow/buggy, changes are difficult or expensive, maybe you want to set up a new product line or brokerage, or maybe Covid-19 has pushed forward your digital roadmap.

Where to begin? Well, to start with you Google ‘insurance software’ or look at the ads in the Insurance Times. There are lots of companies out there, but finding out which is right for you is going to be hard. You contact a few but how to tell if they’re going to do everything you need? There are big companies and small companies. How do you compare apples with apples?

Bit of advice: you need to come armed with a set of requirements. You won’t get very far asking what systems do because they do an awful lot, and lots may not be relevant to you. Ideally, you need a Business Requirements document, or what we call a Scope.

The bigger and better this Scope is, the more likely you are to choose the right company and get the right system.

Shocking admission: Ignite Broker might not be the right system for you! And that’s fine with us. The last thing we want to be doing at Ignite is providing systems to clients who could get better ones elsewhere. There are some great tech products out there and if there is a better fit for your business then go for that.

Ignite is particularly good at certain things – e-commerce, digitisation, integrations, accounting, real-time pricing, the list goes on – but we’re not so good at others – open market products, paper-based operations, London markets, the list goes on.

The scope is all about defining what is important to your company and therefore which system provides best for those requirements. If you’ve got the expertise and time to write a detailed scope document (which can run to hundreds of pages) then go for it! If you haven’t then Ignite can help. The first stage of any project – before contracts are signed. Yes, we charge for it, but it will pay for itself many times over in the long run.

The scope document is systems agnostic, and you’re welcome to show it to other software companies. This way everyone knows what you need from your system and you can truly compare the systems in front of you.

So if you’re looking for a new system, contact us for a demo and talk to us about how a scope document can help you make the right systems choice.

One word of warning: if any company ever says they can build what you’re looking for, don’t buy it. The functionality you need is out there somewhere and comes out-the-box. In a good scope, bespoke work should be at an absolute minimum.

Evolving a data enrichment strategy

9 June 2021

Most brokers/insurers are doing some sort of data enrichment these days – even if that’s only a vehicle lookup to check validity/value/etc, or a postcode to validate an address.

But there’s a lot more you can do with data enrichment, and there is a lot of data out there.

The big question is: where to start, and having started, how should your data enrichment strategy evolve?

Why do data enrichment?

Perhaps the most compelling answer is that everyone else is doing it! But in truth data enrichment also can result in:

- Increased pricing accuracy

- Streamlined customer experience

- Reduced cancelations

- Reduced fraud

To achieve these lofty aims you have to do things with the data, not just have it. And that is where a phased approach to data enrichment is important.

Phase I – validation

Let’s assume you’ve chosen a data enrichment partner or partners. The likes of LexisNexis, Experian, and Percayso (all of which Ignite integrates directly to) all offer an array of data to enrich the picture of someone getting an insurance quote.

There are a number of data fields that may be relevant. Try to collect as many as possible to start with, even if you’re not using them immediately.

In Phase I, concentrate on validation: make sure the risks you’re taking on genuinely are what they say they are. For example, don’t ask a customer if they have CCJs – just get the data and quote/decline based on that. Don’t ask if they’ve got motor claims – use CUE to validate it instead. This has the added benefit of asking fewer questions to the client, which makes their whole experience better.

Phase II – expanding the appetite

After 3-6 months, have a meeting including your data enrichment provider, your software house, and your insurer to discuss additions to the strategy. The discussion might include expanding the risk appetite to cater for technically higher risks (like younger drivers or higher value homes) but with the protection of knowing the providence of the client.

Phase III – claims

After 12 months of quarterly reviews, it’s time to dig into the claims data.

There will be some high-level correlations with claims that you can pick out using just Excel and some common sense. This is where collecting lots of data from the start comes in handy because you can review it now and see what might be relevant.

Implement a small number of changes at a time in order to avoid confusion over what is and what isn’t working.

Phase IV – machine learning

Finally, there are some correlations within large volumes of data that can’t be gleaned with the human in Excel. These include multi-factor correlations such as Age vs Postcode vs Credit Score or suchlike. To understand these insights some machine learning tools are required. This is a relatively specialist and technical subject (which Ignite’s team can help with), but it makes sense to get the easy wins in the first 3 phases first.

Data enrichment offers a complete picture of customers and improved pricing accuracy that can help you achieve a real competitive advantage. Stay ahead of the curve by evolving your data enrichment strategy.

To learn more about data enrichment and how we can support you, get in touch!

What is Insurtech?

27 May 2021

What is insurtech?

Insurtech is a broad term to describe any of a new wave of technologies and companies that are actively trying to digitise insurance. Insurtech can come in many forms, but it is united by the focus on bringing digital benefits – such as automation of processes, online customer experiences, and machine learning – into the insurance space.

Examples of insurtech companies in the UK

Zego – https://www.zego.com/

Percayso – https://www.percayso-inform.com/

Wrapper – https://www.wrapperinsure.co.uk/

For a general overview of some of the most exciting UK insurtech’s visit: https://insurtechuk.org/

Why invest in insurtech?

Insurance is an area that has historically been slow to adopt technology. Industries like social media, travel, and fashion have stormed ahead, where financial services and insurance have lagged behind. Insurance is nonetheless a massive global industry with in excess of $5 trillion a year spent within it per year. The last 2-3 years have seen a considerable upturn in investment in this sector. Success stories of companies such as Lemonade and Hippo in the US and Zego in the UK have shown investors that there are sizeable returns to be made in Insurtech.

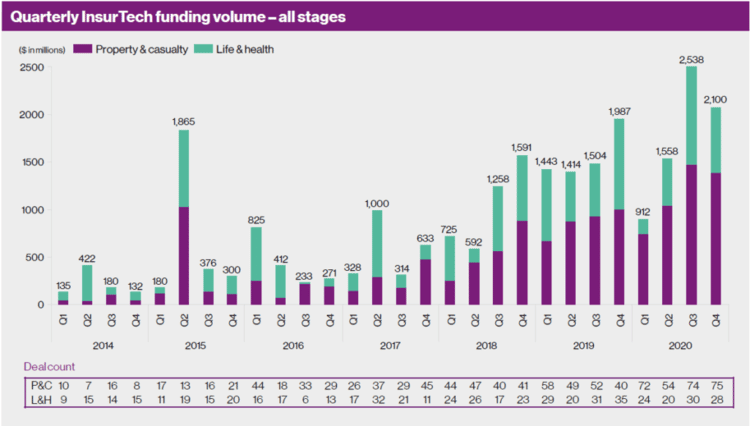

Willis Towers Watson 2020 Insurtech report

What are the benefits?

All participants in the insurance lifecycle benefit from quality Insurtech.

Insurers stand to benefit through better insights into their products through data access, enrichment and analytics.

Brokers can renew their focus on customer service when decent insurtech automates many of their manual processes.

The end customer is more likely to deal with and stay with insurtech-led brokers because their online experience is more pleasant, simpler and integrated.

Insurtech and AI

AI is a buzzword in many industries, and in insurance we can make use of AI in a number of ways. In truth the industry has some way to go before AI (or more likely Machine Learning – ML) is a backbone of all parts of the process. ML is already used by actuaries, but only used to a limited degree so far in customer-centric interactions such as next-best-step decision making and UX enhancements.

Insurtech is blazing a trail that is disrupting the old guard of insurance and the plethora of recent successes and scope for improvement in the market in general can only mean more interest, investment and innovation in this space over the coming years.

Microservices

17 May 2021

The Ignite Broker platform provides a lot of functionality. That’s great, but it’s not always all relevant to our clients. The modern insurance broker needs to acquire best-of-breed software and that means picking and choosing functionality from different providers.

To allow brokers to do this Ignite Broker is built in a modular fashion. Brokers can choose which modules they need and substitute out or enhance ones that they can get elsewhere.

For example a broker might already have a great customer journey and website. No problem: Ignite has an API for that and the broker can use the Ignite policy administration and rating functions without changing their website.

Another example: a client might already have a rating engine (internal or external) that holds their pricing algorithms. Ignite’s policy administration system can simply call to this new rating engine as well as the Ignite proprietary one.

Most recently Ignite has been chosen to provide the Ignite Accounting module for a major broker platform supporting over £180m of premium. APIs between Ignite and the client mean both systems can run and be deployed independently, with loose coupling, and remain highly maintainable and resilient.

How is this done? Rather than having a large system that relies on all its parts to function, Ignite Broker is a series of smaller services that talk to each other, also known as “microservices”. Think of it like a honeycomb, where each of the cells are built on one another; independent but also integrated. For each cell we use the best available tech and, when something better comes along we crack the wax seal (as it were) and substitute in something better.

Some of our microservices include: rating engine, customer portal, commissions, complaints, and more.

If you’d like to read more about microservices go here

If you’d like a demo of the Ignite honeycomb (sort of), go here

The journey to Artificial Intelligence in Insurance

4 May 2021

There have been a bunch of crazy developments in the field of Artificial Intelligence (AI) in the past few years. Google’s AlphaZero beat the leading Go player in 2016 using techniques called Neural Networks and who knows what they’ve achieved in the 5 years since. If you’re interested they publish most of it here: https://deepmind.com/

This blog isn’t really about AI though, it’s about the journey that companies need to go on in order to achieve AI-readiness.

What is AI?

Artificial intelligence (AI) is intelligence demonstrated by computer programmes that mimics human-style intelligence such as learning and problem-solving, as opposed to more traditional ‘computer’ skills of calculation or processing.

Why is AI relevant for insurance brokers?

AI has wide relevance for almost all spheres of industry, but insurance particularly because of the vast amount of data and variables available to analyse. Healthcare has seen a huge surge in AI investment in recent years and it is inevitable that some of this will trickle down to insurance products, journeys and pricing too.

What are the stages to get there?

Most businesses are a long, long way off achieving AI. But there are steps along the journey that they can be making.

Data Access

AI feeds off data. Access to data is therefore mission critical the beginnings of any AI venture. Companies should ensure that their data is readily accessible, structured, and as full as possible to make the most of it, now or in future.

Data Analytics

Humans are good at problem-solving. Better than most machines. Once data has been assembled there are good tools (like PowerBI or QlickView) for visualising it. Businesses should layer such tools onto their data warehouses/lakes and make the effort to analyse the results of just looking at trends and correlations.

Machine Learning

Machine Learning (ML) is the step between looking at an Excel spreadsheet and AI. ML is not ‘intelligent’ in that it needs to be told ‘what’ to do, but it can do what it is told to do better than a human can. ML, properly trained, will notice correlations within data that the human eye cannot spot: it will see multi-factor or multi-dimensional correlations for which there are no easy visualisation tools. Microsoft Machine Learning provides an excellent toolkit for such projects. Building supervised learning algorithms will likely require an experienced or trained data analyst or programmer.

Artificial Intelligence

Once these initial steps have been taken, the door to real AI is open.

Very few insurance companies truly stand at this hallowed portal as yet, but for those that aspire to do so, the previous steps must all be taken. And there is great benefit to be had for the business and its’ customers in doing so.

Benefits of losing your legacy system

14 April 2021

What are legacy systems & why are they bad?

The term legacy system gets bandied about a lot. Exciting new insurtechs view any technology not created in the lasts 5 minutes as legacy. But that’s not the whole truth of it. A legacy system should describe any technology that consumes lots of time in processing workflows or general administration and is difficult to update. In the language of insurance, a legacy system is one that holds a broker back from finessing their existing products or launching new ones.

There’s actually some older tech out there that works very well and doesn’t really need to be updated. Legacy tech just describes systems that don’t work well, not systems that are old.

It should be easy enough to see why legacy systems are bad.

So why not change them?

Changing systems is perceived to be a major headache and business risk. This in itself is quite a dated view. Not only has technology improved in the last 10 years but so has project management and migration. The process of change is much easier than it is often thought to be.

Legacy systems, by their very definition, are holding businesses back. So changing them, and finding the bandwidth to change them, is critical. There are two key elements to consider:

- What do you want from your new system?Answer this by considering where you’re held back at the moment, but also looking to see what is out there. Try to be led as much by what new systems are designed to do (and find one that fits your business) than moulding the system around what you want to achieve.

- Data migrationData transfer is only as difficult as access to existing data makes it. The chief problem with data is not getting it into a new system, but getting it out of your old one. Even before you consider your new system, ensure you have good access to your existing data and do a data cleanse exercise to make sure you have key information such as email addresses for every record. Make this part of your client interaction scripts for a year beforehand to ensure you’re as ready as you can be.

Moving systems also doesn’t have to be a big bang approach. Pick a product or area that you want to change and do it gradually if that makes more sense.

What are the benefits of changing?

When you’ve implemented a new system to replace your legacy system you’ll have new challenges to focus on.

Your processes will be much more efficient and automated so staff that were engaged in admin will need to be repurposed and sometimes retrained. This can bring a renewed focus on quote-to-policy conversion to maximise marketing budget, or improved customer service. The end result will be better renewal retention and brand perception.

Your business development resource will also be freed up from BAU firefighting and can begin to look at new product lines and business expansion. Plan for this as part of your longer terms software strategy.

Replacing a legacy system is a daunting process but often easier than it first appears. If you’re being held back by tech then take advice from systems providers and start the transformation process.

2020 R&D Case Study

9 April 2021

What is R&D?

Research & Development is the time and effort we put in to bettering our product, future-proofing and securing it, and responding to the needs of our present and future customers.

Why do we do R&D?

We do R&D continuously because the market never stays still, and no software is ever complete.

New technologies (everything from file formats to security protocols) and regulations (from GDPR to the CMA) and ideas (brokers are an innovative lot) demand that our systems are adaptable and future-proof.

An R&D project from 2020 – New Rating Engine

Every year we review and update our product roadmap which includes a significant investment of time and resource into developing products and features that will benefit our client base. In 2020, one of those major projects was to re-write our existing rating engine.

Problem we’re solving

Historically, we would use developers to translate an insurer’s rating algorithm into code, but this was time-consuming and therefore costly.

Instead we wanted something that would remove the need for developers in this process, in order to reduce the time and cost of rate builds and updates.

How we did it

Our clients (insurers and brokers and MGAs) tend to deliver rating guides to us in Excel. So we thought – let’s use Excel. Sadly Excel alone isn’t powerful enough to compute the 100,000s of quotes we have to process every day so we researched and developed a tool that would convert an Excel spreadsheet into code.

Using Open XML we now have the best of both worlds: our clients can make rate updates in Excel without needing to learn new configuration tools, and at Ignite, we don’t need any developer intervention to upload them to the system.

Our CTO worked closely on this project with other developers in both our Manchester and Mysore offices and with our BAs and Testers over a period of a few months.

Result – metrics/screenshot

The results of this project have been excellent. Our build time for new schemes has been reduced by over 50%.

Rate updates now take place without a code deployment and can be done in minutes.

For our clients, this means their rate updates are done at zero cost and within minutes.

R&D plans for 2021

- MI App

- OCR

- Next-best-step

Digital Readiness

6 April 2021

What does it mean to ‘go digital’?

Going digital means giving your customers, staff, and management the widest possible array of online and data-enriched tools so they can achieve their aims in whatever suits them best.

How easy is it to achieve?

It’s not always easy. There are three major hurdles to clear:

- Your own mindset – prioritise digital transformation above all other concerns. Growth, client retention, and staff satisfaction will all stem from this.

- Your staff’s mindset – people are often resistant to change. Encouraging your staff to contribute and embrace change is a challenge in itself.

- Your technology – investing in systems that enable digital transformation is often expensive and a journey into the unknown.

What’s the end goal?

The end goal is that your customers can interact with the product and business in the way that they want; that your staff enjoy the benefits of automation of repetitive tasks and seeing their own feedback implemented; that your company is able to make better, more informed decisions and quickly adopt new strategies, technologies, and products as they emerge.

Stages on the journey

- Take a good look at your business, staff, processes, and clients. Be honest about what could be improved, where human intervention is necessary and where it’s not.

- Prioritise the results of your review.

- Assess the barriers to achieving each of the identified areas of improvement.

- Create a strategy/roadmap for increasing your digital readiness.

- Communicate this strategy to your staff and seek their feedback/input.

- Be bold and implement the changes, no matter how seismic or costly in the short term!

How to get started

Every great journey begins with a first step.

Get your key staff and stakeholders together, and begin the process. Allocate time and regular feedback sessions.

If you’re not sure where to start or would like support in starting your digital journey, just get in touch, or you might like to take our digital readiness quiz to find out whether you’re ready to meet the digital demands of 2021 and beyond!

No-code – speed & simplicity

15 March 2021

It is a common misconception that software developers dream in code.

Despite having more than a million lines of code in our platform, we actually dream of no-code.

What is no-code?

No-code is the term for a platform that allows non-technical system users the ability to setup and configure their system using codeless graphical interfaces. For an insurance platform this means that our clients can customise their own systems, rather than having to try to describe what they want and have it built by a bunch of guys in Star Wars hoodies. No-code implementations for our specialist brokers is a key milestone on Ignite’s product roadmap.

What are the advantages of no-code?

In short: speed, reduced cost, and simplicity. Systems can be set up by our BA team on the day of delivery. The setup cost is greatly reduced by removing expensive coding resources. And finally the simplicity of implementation negates the misunderstandings and complexities of scoping and translating requirements. No-code means that our clients get the entirety of Ignite’s large and sophisticated broker system implemented to their bespoke requirements in a matter of weeks not months or years.

Will our clients need to learn no-code?

No! It’s our belief that low-code or no-code should be part of Ignite’s arsenal, not a client’s. At present Ignite Broker clients can amend their question sets, pricing, documents, workflows, users, accounting rules, add-on products, etc… but in reality our expert team of BAs manage that for them. The result of no-code is that our brokers can focus on winning business, client relationships and profitability. System updates happen seamlessly in the background: quickly and low cost. Nice.

Low-code vs no-code?

There’s basically no difference. If you had to pinpoint one, it’d be that low-code admits it can’t do everything, whereas no-code pretends it can.

What is *real* self-service in insurance?

3 March 2021

If you dabble in the world of insurance software (and who doesn’t) then you’ll have come across the concept – and the promise – of “self-service.”

Self-service means that customers can do things for themselves online rather than calling a call centre. This is useful for everyone: customers don’t like talking to people (who does?) and they can manage their policy out of office hours; brokers don’t want to spend money needlessly on manning a call centre (at an approximate cost of £25-£30/call).

A few of Ignite’s competitors claim to offer ‘self-service’ portals, but in reality, few actually do. If they did, why wouldn’t everyone be using them?

Here are a few features of the Ignite self-service portal. The ability to:

- Make changes (i.e. MTAs) of any sort

- Cancel a policy

- Renew a policy or manage the renewal by adding other details

- Purchase additional add-on products

- See claims

- View & download documents

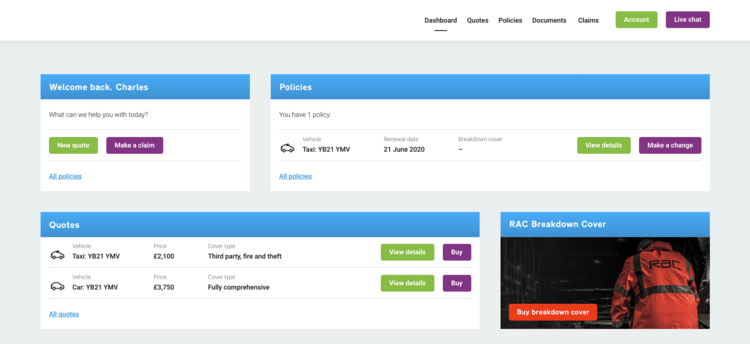

This is an example of what it looks like:

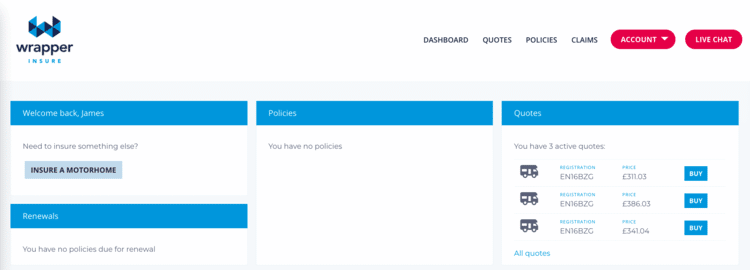

Customers who don’t have a policy can go there to retrieve a quote (this example from the recently launched wrapperinsure.co.uk)

It is important with self-service that it is both easy to use and offers a full range of functionality.

For example, my personal home insurance with Home Protect has a portal, but it is not pretty (see screenshot below), misleading (my policy looks as though it has been renewed twice) and only allows me to download my documents. This puts me off both the brand and the product.

A good self-service portal dramatically increases the number of clients a single broker operative can administer: from ~1,000 to over 10,000.

Customers expect self-service these days, so it’s now standard across all Ignite implementations.