Blog

Personalising the Customer Experience

24 February 2021

Getting customers to come to your website is one battle, but the war is only won once they’ve bought a policy!

A personalised, considered online customer experience is critical to improving quote-to-policy conversion.

In late 2020 the Ignite team worked hand-in-hand with our long-term client, Scratch & Patch, to re-design and build a new client experience.

Since launching in 2015, Scratch & Patch had had a retro feel with this Rockwell font and blocky look:

While the quote-to-policy conversion rate was ok, it wasn’t spectacular. We knew it could be much improved. With this in mind, we worked together to create a new experience that puts the customer first.

The revamped site is slicker and smarter, drawing the eye to the required fields, and less dominant in the colour palette.

Most importantly, the entire customer journey is personalised throughout. Gone are the super-impersonal questions that refer to your furry friend as ‘Pet 1’ – now, as soon as your pet’s name is entered, we refer to them by their name from there on.

What loving cat mom (or dad) wouldn’t want to get Marmalade a policy that’s been made especially for him?

We achieved this using technology called vue.js which is now used across all Ignite’s brokers’ customer sites. Other examples are zoomcover.com and yoga-insure.co.uk

One of the beauties of vue.js is that it looks great on mobile, and also translates itself seamlessly into a smartphone app. All of which is great for Scratch & Patch’s customers who can now enjoy immediate access to their policies, documents, renewals, and claims in their personalised customer portals.

The build took around 6-8 weeks and we’re delighted with the results. The quote-to-policy conversion rate is substantially increased, and the customer reviews are excellent.

Have a go at getting a quote with Scratch & Patch here: https://community.scratchandpatch.co.uk/

If you’d like to see how we can apply these design principles to your brokerage then do get in touch.

Why brokers need to ‘bee’ more

8 February 2021

Here are a few business analogies drawn from the natural world: “busy as a beaver”, “fat cat”, and the business “unicorn”. I’d like to propose another animal-themed business idiom: “build like a bee”.

Follow me on this one. The humble bee makes its home lightweight, a flexible yet strong structure, versatile enough to grow quickly, changing shape and size depending on requirement. If a particular cell in a honeycomb isn’t working, a bee can quickly dismantle and put together a new, stronger structure.

The same should be true of business infrastructure

Many businesses are still inextricably tangled in complicated legacy systems. If one part of the system is no longer relevant or functional, or the business wants to change direction or integrate new, digital processes, it can be incredibly costly and time-consuming; with a high risk of downtime or business interruption, to break down and rebuild the system the way the business wants it.

There are many off-the-shelf products out there, and though it may appear quicker and cheaper to buy the full package and get started, buyers often end up with elements of a system they do not need or want and very little flexibility to do anything about it. Not very cost-effective.

This is the way it has “always been done” (our industry slogan?) and many companies are cautious about doing things differently. We work with a number of clients who prefer to stick with their legacy systems, we get it, and we have worked hard to ensure that we can integrate these systems with minimum disruption, but there is a better, more efficient way. A way that not only sets the business up for now but makes it future-proof with the ability to quickly respond to changes in the insurance-buying and consumption process.

Back to the bee

At Ignite we are seeing an increased adoption of a type of infrastructure that mimics a beehive; a total structure composed entirely of smaller modular elements, coming together to deliver a robust, resilient but most of all, agile result.

This microservice approach allows brokers to pick the specific elements of the system they need, combining best-of-breed modules to build a full front- and back-office, claims, and policy management system. In this way, modules can easily be taken out or added as needed giving the business the agility needed to quickly grow and respond to changes in the industry.

We have long been champions of this honeycomb approach, our Ignite Broker system is built in modular fashion meaning that our clients can choose all or some of the modules they need to build their perfect system; rating engine, customer portal, commissions, complaints, chatbot services – all discrete elements of our system that our clients can choose.

Benefits for the broking bee

This all might sound complicated, and dare I say it expensive, and that may be somewhat true. But in terms of long-term business growth, future-proofing and efficiency, it is the best approach for a growing business, and it isn’t as complicated as it sounds. Depending on your provider, modules can be easily slotted together and integrated with existing systems with little or no system downtime – all you need to do is work with your provider to carefully scope out the areas you need support, and they will tell you the best solution. Not just the off-the-shelf in-house solution, but an array of possible solutions to fit your business.

In a fast-paced, constantly evolving digital environment, most, if not all brokers could benefit from following the lead of the bee and adopting a modular approach to building their business, these are just some of the benefits:

· Pay only for the features you need rather than wasting money on system functions you may never use

· Quickly adapt and build on the system as the business grows and requirements change

· Minimal (or no) business interruption when different parts of the system need adapting

· Best of breed approach allows you to pick and choose the best modules from different providers

If you want to get building like a bee, we can help: Ignite Broker is a modular system that provides all the functionality you need in discrete cells that you can select based on your business need.

Get in touch with us today to arrange a free demo or have a chat about how we can help you.

FCA’s ‘price walking’ regulation and the law of unintended consequences

7 December 2020

In the 1970’s, US states began to require car passengers to wear seatbelts. Sounds sensible right? Unfortunately, immediately following this law there were more accidents, and though people were less likely to be fatally injured in an incident, the new safety mechanism of a belt led to more people adopting risky driving behaviours. Great (and vital) legislation, but who could have foreseen that particular consequence?

In September, the Financial Conduct Authority outlined its proposal to tackle concerns about dual-pricing in the home and motor insurance market. Following a lengthy market study, it found that customers were not benefiting from fair pricing practices, with renewing customers often offered much higher premiums than brand new customers on a like for like quote.

As part of its proposal, the FCA demanded that brokers offer the same price to both new and renewing customers, which on paper sounds sensible and most importantly, fair.

The premise is that those customers who don’t tend to regularly shop round for the best possible insurance quote are not discriminated against or penalised for their loyalty. If all goes well, this should mean that insurance customers won’t need to hunt around for the fairest price, brokers won’t frantically undercut each other to get new business and price comparison websites will have a greater focus on quality of product rather than price.

That might happen. But as with the US seatbelt legislation in the 70’s there may well be some unintended consequences. Let’s consider five possible scenarios arising from banning the seemingly destructive practice of price-walking.

A vicious cycle?

Competition in any market is essentially good for customers as it drives prices down and forces providers to innovate to make sure their offerings stand out to potential customers. Once the FCA bans price-walking, in theory all customers will receive the best possible price meaning they will be even less likely to shop around. Could this lead to innovation in the industry being stymied as providers rely on price-alone to attract and keep customers?

(Don’t) Go Compare

If customers know that they’re getting the best price both first time and at renewal, we are likely to see fewer customers visiting price comparison websites to hunt for the best prices on their premiums. The only problem with this is that price comparison sites need a good volume of traffic to make money to support their marketing budgets, and without it we could see them increasing their prices, a cost ultimately passed on to the consumer.

Fit for purpose?

If brokers are less able to win new business, some less professional ones may seek to regain their financial advantage by offering new ultra-stripped down, ultra-cheap policies that look good to the customer on paper, and in their monthly or annual statement, but on closer inspection may not give an adequate level of cover, leaving them exposed. In this scenario the customer will need to be ever more vigilant about checking their policy summaries and exclusions to ensure that in the event of a claim they aren’t left vulnerable.

Price-walking through a loophole

Brokers with profitable back-books will understandably want to keep their historically profitable customers. To do this we may see them making older products unavailable or difficult to find for new customers. This would then enable them to continue to offer a high price at renewal to existing customers whilst simultaneously launching insubstantially different policies for new business, technically price-walking as they could offer a near like for like product, but at different pricing levels.

Stalemate

Ultimately the market will see less churn, and I believe, less incentive for companies to provide excellent customer service to retain the business of their loyal customers. This could lead to less innovation to drive the industry forward in its quest to meet and exceed customer expectations, which given how far technology and our ability to provide exciting new digital solutions to customers, would be a great shame.

These scenarios could play out in front of us, or they might not, but one thing is certain, major regulatory change always has some unintended consequences.

What chatbots struggle with

13 March 2020

Ignite launched a chatbot facility early this year for our brokers. It’s been an eye-opener. People have come at poor old Iggy (the Ignite chatbot) with all sorts of puzzlers. Top entries include: “does it have like claims on it?”, “Am I going to France?” and “I didn’t receive the discount mentioned by Amber”. Amber doesn’t work for the broker. No one knows who Amber is. Let alone chip-for-a-brain Iggy.

Why do a chatbot?

Our clients – brokers – field lots of calls and live chat requests. Answering these queries definitely costs money, and only sometimes makes money. They’re also only available during office hours. So, to save the broker money and offer a 24/7 service we decided to set up a chatbot.

How do you decide what a chatbot should do?

To make the chatbot relevant to the broker we have them jot down the subject of their calls and live chats for a month, then categorise them by type of query. Those that can be automated (e.g. what is the cancelation fee?) are taught to the chatbot, and those that can’t we push through to the call centre.

How does the chatbot work?

Iggy is a natural language AI learning chatbot – if he doesn’t understand things we teach him how to respond until he can work it out for himself. The more we teach him the better he gets.

What functions does the chatbot do?

The chatbot’s primary function is to answer frequently asked questions. It can also interact with the customer’s data (if they’re logged in) to tell them details about their policy. It can direct the customer to the dashboard where they can amend, cancel and renew.

How good is it?

Iggy answers about 50% of all questions before they reach live chat or the call centre. Imagine that…a little helper that fields over 50% of all your calls. Could be handy that.

What does the chatbot struggle with?

Iggy is very good at noticing spelling mistakes, catching keywords and admitting when he hasn’t got the foggiest. He struggles with questions like these:

- “I’m not sure how much a quote is”

- “If my wife is pregnant can she drive”

- “Are you related to Yogi bear?”

You can only teach a machine so much…

Insuring Santa

17 December 2019

What insurance would Santa need, and how much would it cost? We had a go at getting cover for St. Nick (his database of all households is a GDPR nightmare).

Santa has a lot on at this time of year. So, we’ve taken a thing off his mind by getting him some sensible insurance for Christmas.

First stop: Travel Insurance. Onto the internet. Single Trip. Mini-disaster: CompareTheMarket makes you select all the countries you need cover in. A visit to Google confirms that 160 countries celebrate Christmas. Damn. 10 minutes later. Next issue: baggage cover maxes out at £4,000. Let’s skip that – we’ve got bigger problems than £4k will solve if Blitzen throws a shoe over the North Sea. A little creativity around date of birth and…we’re off…55 companies quoting for the chance…amazing! 9 companies quoted and the cheapest premium is £24.31. Thank you InsureAndGo…

Next on the list: Professional Indemnity. I had concerns about business address, but it turns out that our glorious Post Office has thought of everything. This is – no joke – Santa’s address in case you need it: Santa’s Grotto, Reindeerland, XM4 5HQ. Next thinker: does Santa need Employers Liability cover? Does he pay the elves? Does he have a modern slavery statement? Let’s hedge the bet and get him some just in case. Then the declarations: Have you ever been bankrupt? There will have been years when the kids were especially good that must’ve brought Santa close to the line, but he’s still in business so I’m going with: No. Get Quote…drum roll…2 providers in the mix and the winner is AXA at £276.15. Bargain.

Finally: Commercial Vehicle insurance for the sleigh and reindeer. It’s a tough one because pets invalidate most motor vehicle policies. This’ll need something specialist. Fortunately, KBIS offers an online quote facility for horse and carriage (close enough) and lists possible activities including “Long Distance/endurance (over 40km)” which seemed to cover it. All for the premium price of £469.86.

Total to cover the old round red fella: £770.32

Conclusion: it takes a long time to get insurance for Santa, and it’s not worth it.

Company Values

6 December 2019

We’ve all come across ‘Company Values’ at some point or other, and if you’re like me you probably thought they were bland nonsense dreamed up by HR to make the company seem fluffy to the outside world.

I went to a talk a few weeks back by a company founder who reckoned that establishing an ‘internal brand’ was the most important and difficult thing to get right. So I figured we’d give it a go at our next Innovation Day

Fortunately, at Ignite we’re of a size where we can get everyone in our Manchester office round a (very big) table, so everyone was involved in this process, which was great. We focused on our colleagues, discussing qualities in each other that we admired. We wrote these on post-it notes and put them up on the wall. To divide these dozens of notes into a few categories we came up with real-world examples of when the qualities were evident – someone introducing a new technology that saved everyone time; some who chose a halal restaurant for Friday team lunch to make sure everyone could have chicken; someone who worked late to ensure they weren’t a blocker to a project.

The post-its grouped around each other, and we chose a word that encapsulated that group of qualities. These are our company values. They’re meaningful to us, and we’re trying to refer to them in the way we interact with each other, our clients and our system.

Ignite Values

- Inclusiveness – We work best as a team in a friendly, flexible, inclusive environment. We’re honest and professional, we go out of our way to create a happy environment, and we never let people down.

- Passion – We work hard and take pride in the work we do. We proactively take ownership of new ideas, projects and things that need doing.

- Expertise – We are a team of specialists with deep commercial and technical expertise. We know our clients’ businesses and leverage our technical skills to use that knowledge to help them.

- Innovation – We are always looking to improve, both ourselves and the products we build. We are responsive, creative, and always strive towards higher quality.

Because everyone got involved, all our team can look at that list and associate some part of each value with themselves, their team-mates and their day to day work.

For those of you out there running teams/companies I highly recommend this value-identification exercise (takes about an hour). It’s a positive, creative and energising process and result.

How important is your job?

29 November 2019

I can’t claim original thinking on the insight into job importance that I’m about to give you. Even though the idea isn’t mine I can’t find it on the internet after trying a couple of searches, so I’m going to write it down.

I was prompted to write this post after meeting a chap at an entrepreneur’s event this week who, when I asked him what he did, said “toy maker”. I was so jealous. My job – director at a software house that licences a policy administration platform to specialist brokers – is much harder to say in two words. And also much harder to explain to a 5-year-old.

For those of you wondering how important your job is – here’s a graph to tell you. Simply estimate, in seconds, how long it would take to explain your job to a 5-year-old. Find that number of seconds on the horizontal axis. Run your finger up till you hit the line, take a left, and there you go: your job importance scored out of 10!

If you feel, like me, that it’d take a bit longer than 10 seconds and that maybe ‘never’ ought to be an option, then I feel your pain

Product Roadmap 2020

20 November 2019

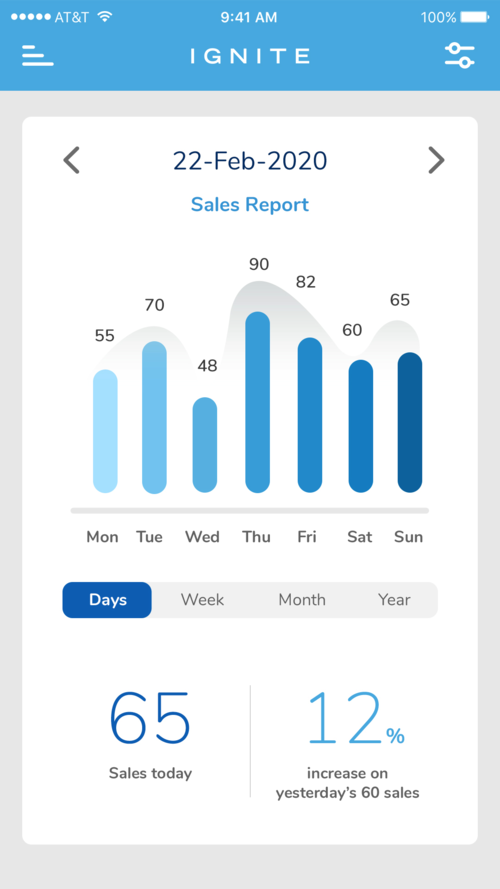

In 2019 Ignite delivered some truly exciting developments on our product roadmap. We stepped up our data enrichment portfolio by integrating with Lexis Nexis and MyLicence; we re-wrote our entire front-end in vue.js with Web APIs to make development of beautiful customer-facing sites quick and dexterous; we overlaid Microsoft’s PowerBI on our client databases to provide powerful reporting dashboards.

Enough of that trumpet – what does 2020 hold? Here are a few highlights:

- Multi-Cover. You’ve seen Admiral and a few others do it. Well, this facility will be coming to Ignite users in 2020. Any end-customer buying a second policy can align their renewal dates and have a single direct debit, as standard.

- Intelligent Add-ons. Brokers often have a large suite of add-on products available but offering dozens to customers is confusing and off-putting. Ignite is building a machine learning tool that looks at the demographics of previous customers’ purchases to recommend the most relevant add-ons, and at the right price.

- Machine Learning. Working with dozens of brokers and major aggregators Ignite sees a lot of data. We obfuscate this data (get rid of personal details like names, contact details, addresses) and store it. In 2020 we’re launching a project to leverage this data using Microsoft Azure’s Machine Learning toolkit to give regular insights to our brokers and insurers.

All these projects will run alongside our usual innovation day initiatives, 3 exciting new client projects (2 of which are top-50 UK brokers), and recruitment to grow both our Manchester and Mysore teams.

2020 promises to be quite a year.

Innovation Day

11 November 2019

Innovation Day might sound like some ham-fisted new government initiative to boost national productivity. And one day it might be, but for now it’s a monthly day of blue sky innovation that we do at Ignite.

Aren’t you innovating all the time?

Sure, that’s what the marketing people will tell you. But really who ever gets a good chunk of time to chew ideas over with their teammates, to build prototypes, try new technologies? Pretty much no one – day to day work is too full on. So we started doing Innovation Days

How does it work?

One day a month (always a Friday), we schedule no regular work. Everyone comes in to the office and splits into self-defined teams. Teams include business analysts, devs, testers, senior managers and board members…basically everyone! The challenge is this: come up with an idea and build a working prototype to show to everyone at the end of the day. It can be anything: from a sales tool, to a new customer interface, to a new app.

And then what?

Pretty much all of the ideas we’ve worked on have been great ideas. But not many actually work. The great skill of Innovation Day is not coming up with a killer idea, but the ability to break it down into its most basic form so that it can be built in a day. It just so happens that this is great practice for the day to day business of delivering software projects. And good fun.

What have you come up with?

Too many things to list, but here are some highlights: a visualisation of the timeline of a policy (that went into production environments a week after the innovation day); a live MI smartphone app for MD/CEOs; a project run entirely through Microsoft DevOps; a super-fast batch automation test tool for schemes; and an advance site health monitor.

If you’re reading this and you’ve got any ideas – send us a message on Linkedin or privately and we’ll see if we can’t build it for in a day…

Agile

1 November 2019

If you’re a broker, it’s probably been a while (since you last undertook a big software project)…

At Ignite we’ve done over 40 implementations in the last 7 years. In that time we’ve learned a lot. So here are a few of our learnings about project management:

- It is impossible to perfectly predict an end date for a 4 week+ project

- Requirements change

- We know something will go wrong during development, but we don’t know what it is yet

It’s not an ideal list. Ideally, you would know when you’d get your system and that you’d get all of it.

That’s why we run our projects using the Agile method. We do this to mitigate all the problems listed above.

Here are some of the key principles of working agile:

- Working software is the primary measure of progress

- Our highest priority is to satisfy the customer

- Business people and developers must work together throughout the project

That’s a better list!

By focusing on that second list the first one becomes less problematic. To demonstrate:

- Predicting an end date matters less if working software is seen to be advancing throughout the project

- Changing requirements are welcomed and discussed with the customer so they understand the impact of change on delivery and cost

- When things go wrong business people understand the reason and the impact immediately

Our process is constantly evolving but if you’re a broker looking at a system don’t expect to specify everything, wait 12 weeks, and get a perfect system. You’re going to be involved throughout.