R&D 2022

10 February 2022

At Ignite we spend over 50% of all our time doing R&D for our clients and core system. Here is a run-down of some of the projects we’ll be working on in 2022:

Configurable alerts

It’s all very well having snazzy dashboards (as we do) so that our clients can see all their live KPIs. But you can’t be glued to that screen and still do your job.

That’s why in 2022 we are creating a series of configurable alerts based on key data metrics so our clients get notifications when numbers and ratios important to them change.

New Call Centre UI

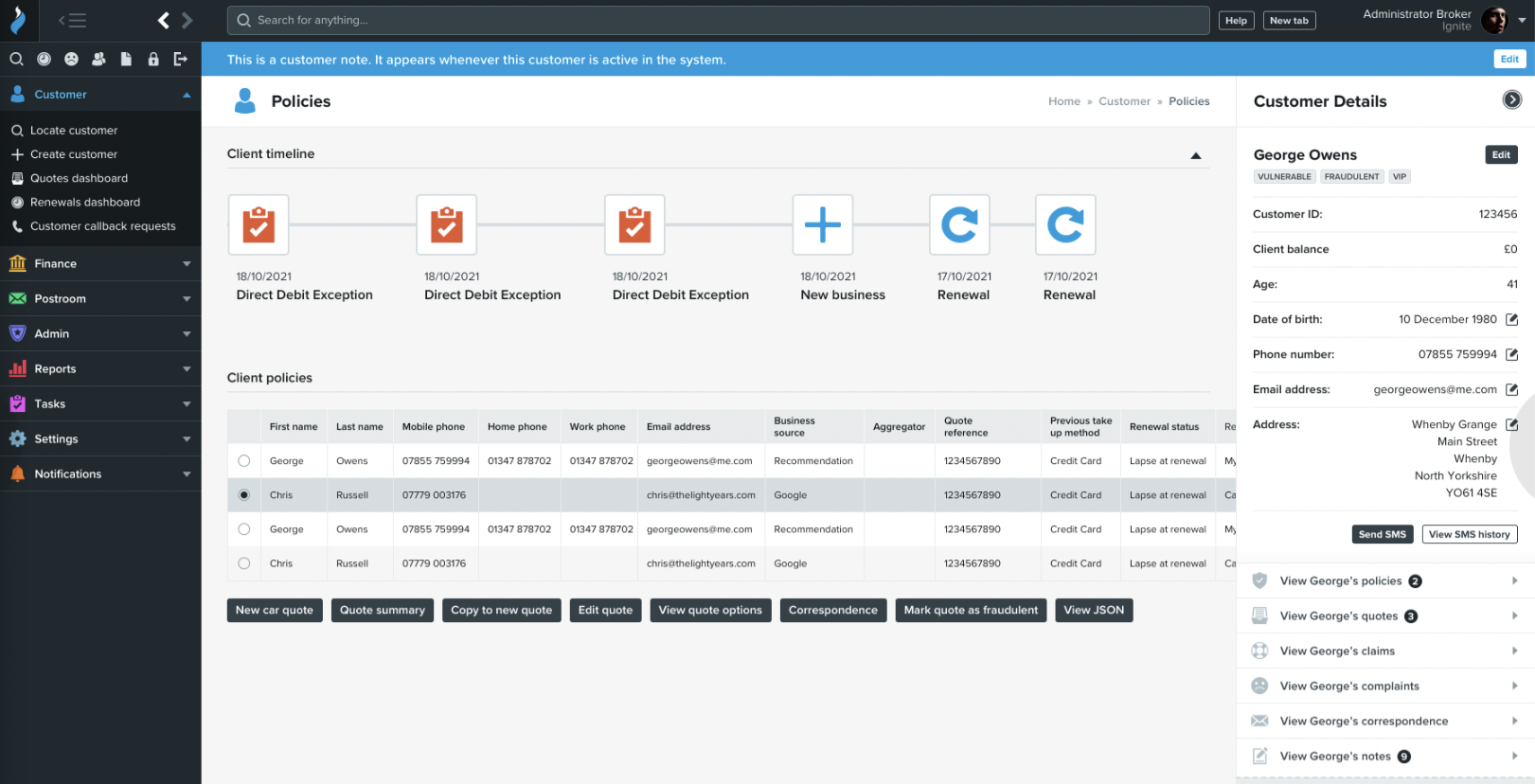

The current Ignite back-office interface is pretty pretty but we are always looking for how to make things easier and slicker. Will be reviewing both the UI and the UX, i.e. looking at the colours, fonts and buttons, but also the accessibility of key system areas, and how to make system use as intuitive as possible. Here is a sneak peek of the early designs…

No-code question set builder

Some Ignite products (i.e. question sets) come pre-packed, like motor, home, and pet. There might be small variations which we allow but the structure is largely determined by the price comparison websites which drive the majority of traffic to these lines of business. There are of course other products which Ignite also supports. To aid the speedy development and control of these non-standard products (e.g. gadgets, cycle, gap, SME, et cetera) ignite will be expanding on our existing question set builder.

At present brokers can self configure their own products including all questions and document templates. The 2022 iteration of the question set builder will auto generate API endpoints for easy integration to third-party rating or distribution services, allow for more complex questions that design, and feature a more curated database structure.

Analytics Team & Dashboards

In 2022 Ignite will be forming a dedicated analytics team to proactively bring data insights to our broker and insurer partners.

We will build upon our existing PowerBI and Grafana dashboard tools, and leverage access to Microsoft Machine Learning tools as part of our Microsoft Partner Company status.

We anticipate that this team will help our clients optimise workflows, increase new business and renewal take-up rates, and identify new product opportunities.

Other things

As usual, we’ll be running our monthly innovation days from which many great new roadmap ideas pop up. We’ll also be putting live 6-8 major brokers, and integrating the products of 6-8 major insurers. Big year? Sure.

Ignite Exhibit at BIBA 2022

2 February 2022

Ignite will be exhibiting at the BIBA Conference in Manchester in May, on stand D80.

We’ll be showcasing our policy administration system to brokers, and talking about our recent acquisition by Verisk and the benefits it brings to our clients, existing and future.

Data migration is fun!

1 February 2022

Data Migration

Data migration is not the fun bit. When you’re upgrading your business’ technology stack with a new system the new app is the fun bit, the automation, the chatbot… that stuff. But not the data migration.

Why isn’t it fun?

There’s a few awkward bits: firstly, before you can kick off data migration you need to get hold of all your data. As a first step this involves letting your old girlfriend (software house) know you’ve got a new one. Then, as they’re processing that little bombshell, they’re asked for a machine-readable data dump for a transfer. Like asking a newly ex-ified girlfriend if she wouldn’t mind just transcribing all your years of conversations and providing them in a4 notebooks with equally spaced columns, grouped by date. This has to be tactfully managed to avoid being a real dump of a data dump.

How it gets into the new system

There are a number of ways to get data into a new system. Not all of them are horrible, and there are often lots of benefits to the process. The basic options (all of which Ignite has done as some point) are: feeding the data through a validated API configured to requirements; using the automation framework to input risk details through the UI’s validation; rekey. Horses for courses, and none are options to be ruled out.

Benefits of data migration

Lots of companies have pre-GDPR data that they haven’t dealt with appropriately. Data transfer is an excellent way of correcting this issue. Data can also get a bit mangled over time with inconsistent inputs or database types. Data transfer, especially through a validated API or automation framework offers the opportunity to cleanse data into formats that can better reported on and understood.

Business risk

Data transfer is perceived as a business risk. It is true to an extent, but these days it is increasingly seamless: test runs can be done in minutes, and mapping is increasingly easy. Part of the skill comes in designing the new system. If, in migrating, the existing product structure is largely retained, with upgrades to the functionality around it rather than the data capture itself, then migration can be easier. Also consider how much data really needs to be transferred, and what can simply sit in an external data repository to be used for uncommon events like an investigation.

Cost

Data transfer no longer needs to be expensive. As long as there is decent access to historic data in some sort of machine readable format (e.g. historic EDI or Bordereaux) then it is something that, with proper management, can be done without headache or heartache.