Pet Tracker Insurance

7 February 2024

Tractive, Covéa, and Ignite have combined to create a market first pet tracker + insurance policy.

Tractive has 1 million subscribers globally for it’s pet wearables products. Now UK customers will be able to buy an insurance policy alongside their device, underwritten by Covéa.

Ian Bubb, IT Director & Head of Specialty Lines at Covéa: “When Tractive came to us with this proposition we knew it was something we had to get behind. This product will do well in the short-term and provide fascinating learnings for the future too”

All policies will be transacted through the Ignite Broker policy admin system, with end customers able to buy, MTA, and renew in their Tractive portal

Read Insurance Times coverage here

SSP replacement for Quotax

30 January 2024

Specialist Motor & Commercial broker Quotax chooses Ignite Policy Admin System to power future growth

Ignite has partnered with Specialist Motor & Commercial insurance broker Quotax Insurance Services (Quotax) to become its new broking system provider.

Replacing the broker’s legacy SSP system, the Ignite Broker platform will significantly enhance operational efficiency at Quotax and provide it, for the first time, with powerful digital capabilities. The move is backed by IHP integrations with insurers Markerstudy and ERS, and will see over 10,000 policyholders migrate to the new system.

Quotax’s customers will benefit from a customer-centric online experience, complemented by Quotax’s industry-leading call centre expertise in the market.

Toby MacLachlan, CEO at Ignite said: “Quotax have the values of a traditional broker, with the drive and ambition for innovation to offer their clients the best advice and flexibility with options. It has been a real pleasure to work with them and their insurers on this project – they have embraced our agile methodology, and as such we’ve jointly cleared any hurdle that has come up.”

Brokers launching 2nd brands

15 December 2023

What’s behind the wave of brokers setting up second brands?

Read the full article in Insurance Business Magazine here

2023 has been a busy year for the insurance broking sector and the companies that work to support the health and sustainability of this market. Between regulatory pressures, the acceleration of generative AI as both a point of discussion and a point of differentiation, and the troublesome economic conditions impacting providers and insureds alike, ‘what next?’ was the question of the mind of so much of the market this year.

In the midst of so much upheaval, it has been interesting to see how brokers have pivoted to meet these challenges head-on, and one key directional shift seen by Toby MacLachlan (pictured), CEO of Ignite – a Verisk business – has been the increased number of brokers setting up second brands. There was a small wave of brokers that set up second brands at the start of last year due to the fair pricing regulations, he said, and he expects to see more of this activity going forward, albeit for different reasons.

What’s behind the move towards second brands?

“Lots of larger brokers are stuck on legacy platforms,” he said. “Re-platforming presents a business risk/interruption that is a major obstacle to innovation. So, lots of larger brokers are considering/doing second brands. This allows them to use the latest technology, like Ignite, without the risk of data transfer and the headache of full staff retraining.

“They can start with a single product and do interesting things with it (like variable policy terms, multi-vehicle, self-service etc) that would be all but impossible on their main platform. And they can then run both side by side, share learnings and best practice, and invest where appropriate.”

Identifying some of the key factors at play behind this trend, MacLachlan noted that brokers are keen to innovate. They’re entrepreneurial and full of ideas, he said, and it’s important to recognise that brokers have no lack of willingness or funding to innovate. Rather, they are held back by legacy tech that is slow and expensive to manipulate.

“The key factor behind the wave of second brands is not just fair pricing, it’s a desire to try new things and keep up with those that are innovating,” he said. “Another reason brokers are setting up second brands is to do with business risk. The FCA is considering regulating key software systems like policy admin platforms.

“The risk that these big, legacy, core platforms represent has come into the limelight. Much-publicised outages from other software houses are just one example. In an age of regular cyberattacks, all systems are potentially vulnerable. Having a second brand on a second system mitigates risk to brokers that, if their core system goes down, really have no disaster recovery strategy in place at all.”

What impact are these second brands having on the market?

What’s been fascinating to see is the knock-on effect the setting up of second brands is having when it comes to fostering innovation among larger brokers. Second brands are an ideal place to innovate, he said. They tend to be smaller and nimbler than the core brand and are therefore ideal forums for testing changes and new ideas.

With that in mind, MacLachlan also highlighted the implication this trend is having to help ensure these brokers are meeting fair pricing regulations. Regulatory challenges tend to be most challenging when there is poor access to data or automation, he said, while second brands, with a smaller back book, are easier to adapt to regulatory change.

As to the impact this move towards brokers establishing second brands is having on the customers on the other side of the insurance value chain, MacLachlan noted that the end insureds “undoubtedly” benefit from second brands. New products tend to be digitally enabled, he said, giving customers more choice, and lower overheads, giving customers better priced policies.

What’s next for Ignite?

2023 was a year of acceleration for Ignite itself, seeing the insurance software house launch an accelerator programme to drive innovation in insurance broking and be selected by Hagerty Insurance Services (Hagerty) as its new broking system provider. With his attention turned to 2024, MacLachlan said he expects AI to inevitably dominate discussions and headlines next year.

“There are clear use cases for claims and pricing, but also more subtle ones in broking administration,” he said. “Brokers’ staff are essentially training people interacting with data. This is something that generative AI does well, and should be harnessed as such. Ignite launched its AI Layer technology in 2023 and will be publicising the positive real-world impacts and use cases of this in 2024. “

Unleash the Power of AI in Insurance: How to Drive Efficiency and Growth

5 July 2023

There’s lots written about AI (even in insurance!) these days, but how many brokers are actually using it? Very few, if any. This blog is about one-way brokers can actually (actually) make use of AI in a real-world way.

Why would brokers want to use AI? Commercially speaking, brokers want to do two things: drive revenues up and costs down. Ideally, AI should do both of these things.

The Aim

The aim of Ignite’s new data-retrieval ‘AI Layer’ tool is to create an amazing data-engaged call centre assistant and chatbot that saves brokers’ staff and their customers time.

This ‘AI Layer’ will answer customer queries without the pesky need to actually go find the data and type out a response. If this works it will:

- Improve out-of-hours customer interactions so customers are happier, more likely to recommend and renew

- Reduce admin time per policy, either through more efficient call centre work or customers self-serving, leading to lower staff requirements and reduced overheads

- Create a feedback loop into systems and products so that they continuously improve

The Use Case

Take a given broker with 100k policyholders (although it could be 10k or 1m). They currently have 6 staff (this is a real-life use case).

They want to quadruple their policy count in the next 2-3 years.

Do they want to quadruple their staff count? No, they want to halve it. Doing so would equate to a saving of over £0.5m a year in staff costs alone.

How do we achieve that? A good start is by allowing customers to do more themselves on a self-service portal, but… we already do that. They can already do all MTAs, cancellations, renewals, direct debits, etc. Those that cannot help themselves resort to live chat agents.

If we can handle more customers at once then we need fewer agents rather than more. To do that we need to provide responses for agents so they don’t have to spend time digging around for data and typing answers.

A bit of experience

In 2021 Ignite launched an AI (NLP and ML) Chatbot to answer common customer queries (such as how to change direct debit dates, or how to make an MTA). In 2022 we processed nearly 100,000 chats with 1,000s of customers.

But this chatbot was not connected to the customer database, so even though it answers 50% of (FAQ-style) queries pretty well, the second 50% was going to be a fair bit harder.

Ignite’s AI Layer

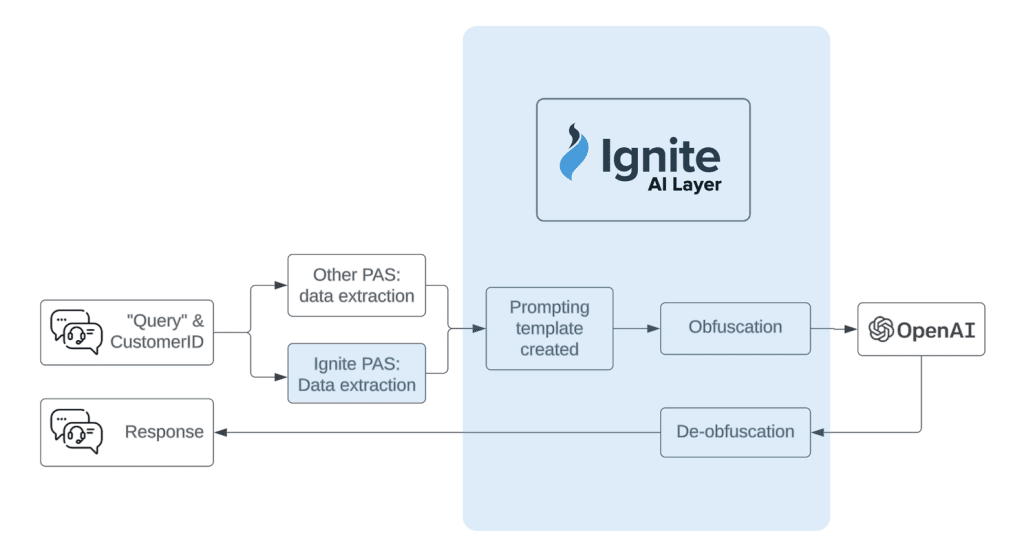

When customers have a query we send their (typed) query to our AI Layer.

Our aim is to have their query answered by AI. To do this we need to:

- Know the customer

- Not breach GDPR

- Provide useful responses

Ignite’s AI layer is doing three things:

- Fetching as much relevant customer and policy data as possible

- Obfuscating the data so we’re not breaching GDPR guidelines

- Re-formating that data into structured prompting templates so the AI responds usefully

What does it actually do?

It answers questions, quickly and accurately.

For example, if a customer asks “What are my excesses?” it will immediately (2-5 seconds typically) answer “Your voluntary excess is £x and your compulsory excess is £y making a total excess of £x+y” (where x and y are the right numbers based on the policy record). Or if asked, “Am I covered for driving other cars?” it will answer “yes” or “no”. In each case the live chat or call centre operative doesn’t need to either open the customer record or type the reply.

And if a customer asks: “how can I save money on my insurance?” it will answer “I’m afraid I don’t have data available to answer that question” (rather than giving an ultra-polite greatest hits of legal-or-otherwise hints from the wider internet which is what ChatGPT would do).

How does it do this?

Ignite’s AI Layer works in a similar way to ChatGPT, except that instead of just asking the question, we give the engine a whole lot of pretext/context so it can better answer the question. Things like policy dates, costs, cover details, etc.

How do brokers use this?

This tool is already available to brokers using the Ignite policy administration platform. It will be available as a plugin to other/legacy PAS systems in the coming months.

If you’d like to see a demo, hear more about this project, or find out when it becomes widely available, get in touch.

Insurance 2023

3 February 2023

Industry trends in 2023

2022 was an interesting year in insurance. Kicked off by the ‘price walking’ bombshell on Jan 1st we saw lots of market churn, aggregator volumes down, and frenetic rate resetting. Then the domino effect of Putin > energy prices > mini-budgets > (claims) inflation… cue more pricing faff. What will 2022 loss ratios look like? All over the place most likely. And on the tech side of the equation, all tech stocks (and tech investments) took an Olympic finals-sized dive. Wages up, investment down, rates everywhere… messy. (Thankfully Ignite is fine)

The end of digital transformation

One of the over-hammered phrases from 2022 was ‘digital transformation’. It gets touted by all the tech firms and larded onto every press release and industry feature piece going. Well, I’m going to draw a line in the sand and say that digital transformation is now ‘done’. Lots of brokers have already done it, are finally doing it after years of procrastination, or won’t do it (bless ’em). I don’t want to overblow the trumpet but all Ignite brokers are digitally transformed: they’re 100% cloud, offer customer digital self-service where required, and have low-cost bases through high automation. 2023 will be about digital transformation for some, but I’m most excited about 2023 being the year of product development. This is something that rarely happens when digital transformation is happening – the focus is usually on digitising what’s already there. Now (by proclamation) the transformation is done… roll on product innovation.

Exciting stuff

So what product development will we see? Here are just a few things we’re already working on that will be fun:

- Long-term policies. Why stop at 1 year? With inflation riding high at 10%, a 3-year car or home policy is suddenly quite attractive. In general flexible policy terms will become the norm.

- IoT. Cars and homes (and even pets) are connected these days. We’ll see new products informed by data dissemination that others can’t compete with. All cars made after 2019 (and many before) are ‘connected’ and their live data accessible to insurers. This has been talked about for a long time but it’s becoming cheap and will therefore soon hit the mainstream.

- Price optimisation. AI has come to town and it’s here to stay. If you don’t believe me you’ve not asked chatGPT to write you a love poem about underwriting. This (AI not the poem) will make pricing so much more dynamic and render massive hoarded data sets increasingly redundant. Market benchmarking, live pricing data and AI-driven product flexibility will become the standard.

The end of insurtech

Another word that’s going to be increasingly problematic is Insurtech. With the macro-economic climate being what it is (rubbish) there will be a fair few insurtechs falling by the wayside. However quietly they do it the brand will still be tarnished. Years of outlandish claims (we’ll get you live in 24 hours/2 weeks/pick your poison) and insurer hostility haven’t helped, and so 2023 may well be the year we see companies distance themselves from the term. That’s why we’ve drawn another line in the sane: Ignite, now 10 years old, is a software house, not an insurtech.

What else is not happening in 2023?

Finally here are some things that I don’t believe are going to disrupt anything this year.

- Embedded insurance. It’s just not happening. The idea is good (insurance at the point of product purchase), but the tech and capacity and investment required to make it really work are just not justified by the volumes available. Expect one or two nice examples but no stampede.

- Never-ending consolidation. The consolidators have spent a merry few years buying up every Tom, Dick and Hastings at inflated prices. It’s fine to have £1bn of debt when the base rate is 0.25% but at 4%+… less so. Might we see a collapse or two and a hoovering up of the pieces? Maybe not right away, but if things drag on as they are then who knows…

- Low-code/no-code. I’ve yet to see a really impressive system for insurance that is low- or no-code (or at least one that doesn’t require plenty of training, have severe limitations that require coding, and which can’t be messed up in 2 minutes by an incompetent operator). And anyway, these days you just ask ChatGPT to write you code for what you need. Now that’s real no code 🙂

And finally, what of Amazon insurance? Their current aggregator-lite home insurance site will soon be joined by motor. Will there be an upgrade to the current system/model? They’ve just made 10,000+ redundancies so it remains to be seen whether this newly-launched insurance offering will snowball or mothball…

Ignite launches accelerator programme to drive innovation in insurance broking

16 January 2023

Press Release – Ignite Insurance Systems (Ignite), a market-leading policy administration software house, is excited to announce the launch of Ignition, an accelerator programme that will support start-up insurance brokers to launch and grow their own successful businesses.

Through Ignition, Ignite will co-fund new-start brokerages that have some backing outside of the programme, providing innovative administration software solutions tailored to their specific needs and unique business propositions.

The accelerator programme will also offer support in all other key aspects of launching and growing a brokerage, including: accessing capacity and distribution channels, regulation and compliance, marketing support, and more.

Matching Ignite’s internal recruitment strategy, Ignition is targeting a 50/50 split of female/male founders through promotion of the accelerator through women in insurance networks and no requirement to apply beyond some commercial experience.

Jess Burton, Head of Operations at Ignite Systems, said:

“We’re excited to be launching Ignition, a programme that will jump-start innovation across the broker market, and help entrepreneurial men and women with fresh ideas forge their own path.

Increasing consolidation of brokerages is on the verge of stifling creativity and can lose sight of the end-goal: a personalised, digital-first service offering customers easy access to relevant, high-value products.

We’d love to hear from experienced insurance professionals that have a business idea or have already launched their brokerage.”

For more information on Ignition and to apply, head to: https://ignite.systems/ignition/

Press Coverage:

Ignite chosen to power growth of specialist classic car brokerage Hagerty

9 January 2023

Press Release – Ignite Insurance Systems (Ignite), the fast-growing insurance software house, has been appointed by Hagerty Insurance Services (Hagerty), a leading UK classic car insurance broker, as its new broking system provider.

Ignite Broker – Ignite’s cloud-based policy administration platform – will handle the entirety of Hagerty’s book of classic car business. The move is part of the broker’s 5-year digital transformation strategy to support its strategic growth objectives.

Replacing the broker’s legacy OpenGI system, Ignite Broker will drive significant operational efficiency improvements and provide Hagerty with the capability to link into market-leading CRM software, data enrichment, and a customer front-end experience. The system is fully enabled for Hagerty’s core multi-car business, including cars, bikes and specialist vehicles, and supported by insurers Markel and Aviva.

Toby MacLachlan, Managing Director of Ignite said: “Hagerty is one of the most forward-thinking brokers we have met. They’ve got a clear and bold idea of their future strategy, and we’re delighted that they have selected Ignite to join them on this journey. The multi-vehicle customer experience has been a great challenge to work on and really satisfying to see live today. Most of all I’d like to highlight the Hagerty team’s thoroughness in scoping, collaboration and testing all of which have made this project a huge success.”

Mark Roper of Hagerty, said: “At Hagerty, we believe in providing exceptional service across all channels. We have ambitious plans, which require a software partner that aligns with our vision and aspirations. After an extensive market review the Ignite system was the only one that would fully support our continuous innovation strategy, whilst enhancing our customer service focus and back-office efficiencies.”

Scale, sizeable pizzas, and learning to trust

15 September 2022

1 year into Verisk…

Since becoming part of Verisk a year ago this month, Ignite has grown and grown up. Headcount has grown 64%, recurring revenue is up 76%, and we’ve brought on some big new clients.

One of the challenges of scaling up is to maintain a company culture and knowledge base even as so many new people join. To achieve this we’ve created lots of small teams (up to 6 people) that operate independently. This means we can slot new people into teams and they get lots of face time with experienced hands, and knowledge is passed more intensively.

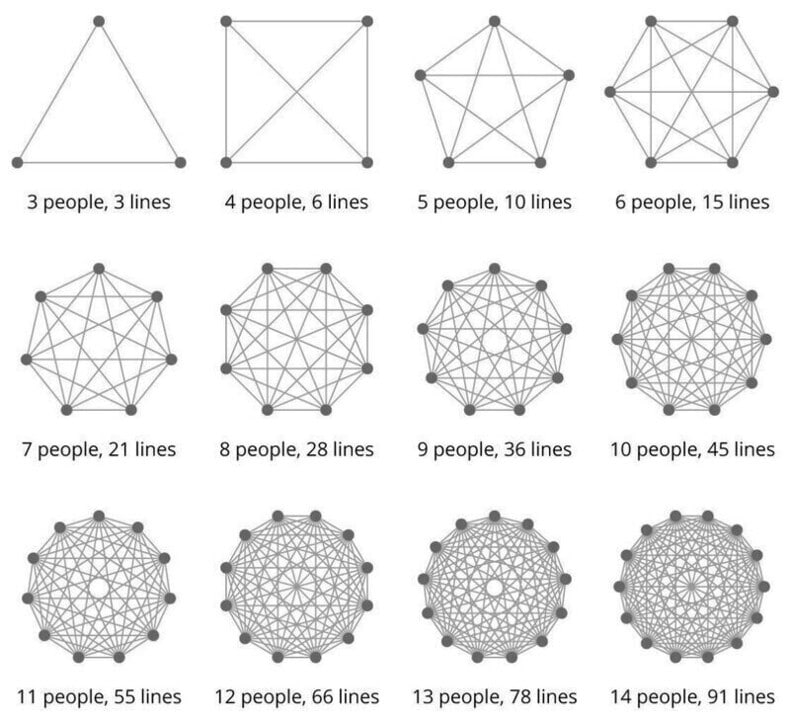

It turns out this idea isn’t new. Brooks’ Law states that “adding manpower to a [late] software project makes it later”. And everyone knows anecdotally that 3 people working together are way more efficient than 10 people working together. The diagram here illustrates why.

In our Ignite teams of 6 people, there are only 15 lines of connection, a manageable number for day-to-day interactions. Add another 6 people and those 15 lines explode to 66 lines: people don’t talk enough within the team (there just isn’t time) and knowledge is lost.

Not only did Fred Brooks get there before me (in 1975 in fact) but so did Jeff Bezos.

The rule that this (seemingly parsimonious) billionaire espouses is that no team should be so large that it cannot be fed by two pizzas. It’s the same thing really: teams are small, agile and empowered to make decisions. Micro-management is the enemy of progress.

And what do all these maxims boil down to? Trust.

In a small company, you know every one of your staff so you trust them. In a larger company, you don’t know everyone, so it’s harder to trust them (that they’re working hard, making good decisions and doing the right thing). The temptation is to gather as much data as possible, like timesheets and reports, create committees, etc. But this is just micro-management by stealth.

If you trust your core team, then trust the people they trust. They’ll thank you for the show of faith, and the time they get back by not having to do endless time reporting or memos.

And if your team isn’t working hard, isn’t making good decisions and you don’t know about it… well, you’re stuffed anyway.

MGAA 2022

6 July 2022

What a difference a year makes. MGAA 2021 was mired by covid, masks, and low attendance. 2022 was buzzing, with a notable step up in attendance especially from more direct channel players and providers. The agenda was geared around optimism and harnessing the current cyclical peak in interest in MGAs.

BIBA vs MGAA

Ignite has always felt BIBA was it’s home-ground conference, given we licence a policy administration platform. This year the MGAA felt a lot like home given how many MGAs are going direct and harnessing self-service PAS solutions to go to market B2C with low cost overheads rather than via brokers.

Verisk

Verisk – our parent company – were also exhibiting. As usual the event was an opportunity to learn more about the breadth of products within group and the surprising number of MGAs and carriers already using Verisk products and data sets.

Insurtech

There was the usual proliferation of ‘insurtech’ offerings. It again made me think that Ignite is no longer an insurtech, and reinforced in my mind that being specialist in certain product types is critical for insurtechs. Of course it’s possible to move sideways sometimes, but the effort is high and the timescales long. It has taken Ignite a good 5 years to become a market leader in providing a policy admin system for motor products for UK brokers; building out pet and home have taken almost as long again. The idea of breaking into something totally new like SME is chilling!

MGA optimism

Another recurring theme of the conference was optimism. MGAs are cyclically popular. Right now they’re on the rise again. There are two reasons for this:

1. brokers want more agile partners as insurers have become bogged down with recent regulation and pricing reforms

2. there are really good B2C self-service technology solutions out there these days which means MGAs can go direct without needing a massive headcount or brokers.

These two points are in addition to the perennial benefits of MGAs in terms of better ratios and specialism that insurers lack.

All in all the conference was a great success – credit to the organisers. Ignite will certainly now becoming a member and exhibiting in 2023…

Employee Spotlight: Amy Easterbrook

20 June 2022

AMY EASTERBROOK

Data Analyst Apprentice

Amy is an Apprentice Data Analyst here at Ignite!

As one of our ‘newbies,’ we’ve asked Amy to answer a few questions for our latest Employee Spotlight piece…

What three words would you use to describe Ignite?

In three words I would describe Ignite as innovative, agile and supportive.

What are you most looking forward to?

In my role at Ignite, I am most looking forward to when I can dive into the data analytics side of the role with confidence.

What drew you to Ignite?

I was drawn to Ignite because of their innovation days and the chance to learn more about the data sector, I felt that the role was perfectly suited for that.

In my short time at Ignite, I have already learned so much.

What do you hope to achieve in the next 2-5 years at Ignite?

In the next few years at Ignite, I hope to be able to learn a great deal more and be able to analyse/report more complex datasets.

Get to know more Ignite newbies in our Employee Spotlight Series:

Christian Wright, Head of Business Development

Matt Snape, Head of Sales and Marketing

Steven McManus, Apprentice Software Engineer

Interested in an apprenticeship at Ignite? Click here to find out more.